Question: Exercise 24-1 Payback period computation; uneven cash flows LO P1 Beyer Company is considering the purchase of an asset for $200,000. It is expected to

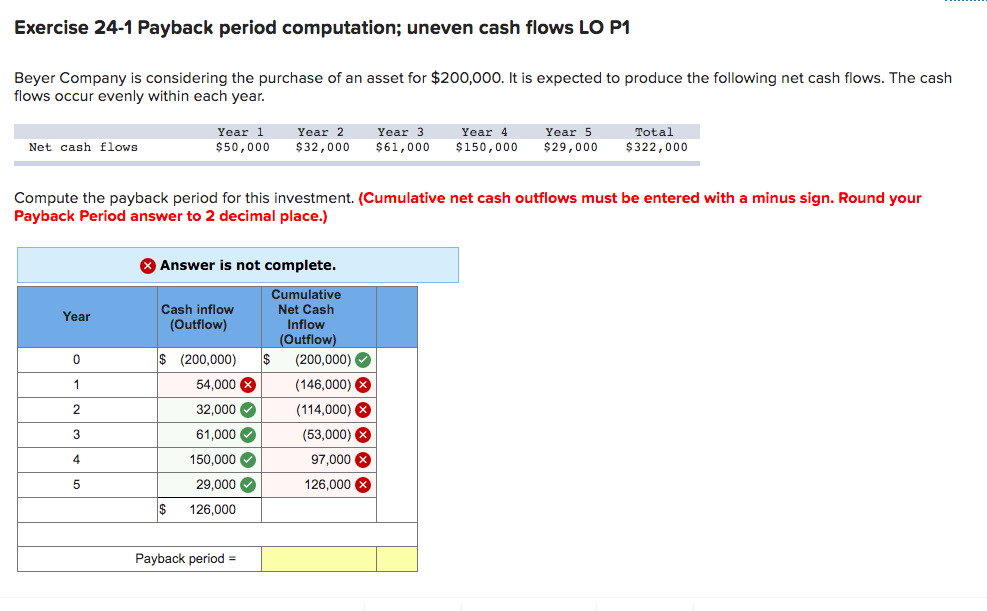

Exercise 24-1 Payback period computation; uneven cash flows LO P1 Beyer Company is considering the purchase of an asset for $200,000. It is expected to produce the following net cash flows. The cash flows occur evenly within each year. Year 1 $50,000 Year 2 $32,000 Year 3 $61,000 Year 4 $150,000 Year 5 $29,000 Total $322,000 Net cash flows Compute the payback period for this investment. (Cumulative net cash outflows must be entered with a minus sign. Round your Payback period answer to 2 decimal place.) X Answer is not complete. Year Cash inflow (Outflow) Cumulative Net Cash Inflow (Outflow) $ (200,000) (146,000) (114,000) X 0 1 2 3 $ (200,000) 54,000 32,000 61,000 150,000 29,000 $ 126,000 (53,000) X 4 97,000 X 5 126,000 Payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts