Question: Exercise 24-14 Computation and interpretation of net present value and internal rate of return LO P3, P4 Phoenix Company can Invest in each of three

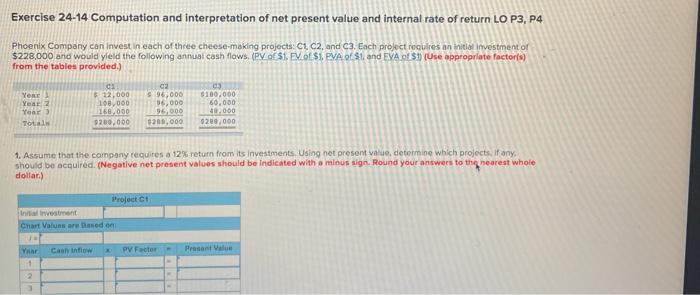

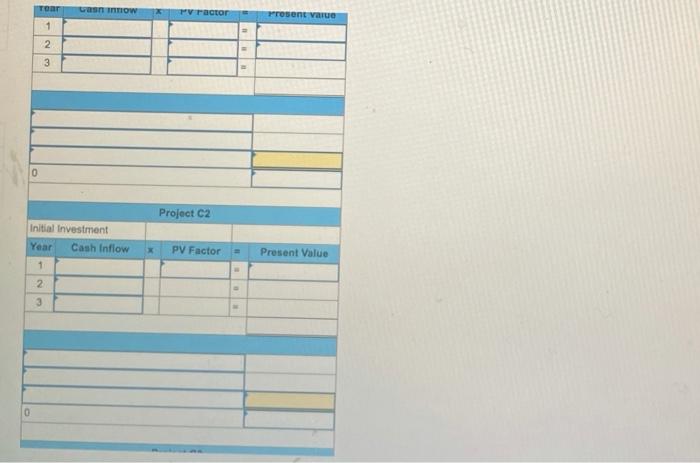

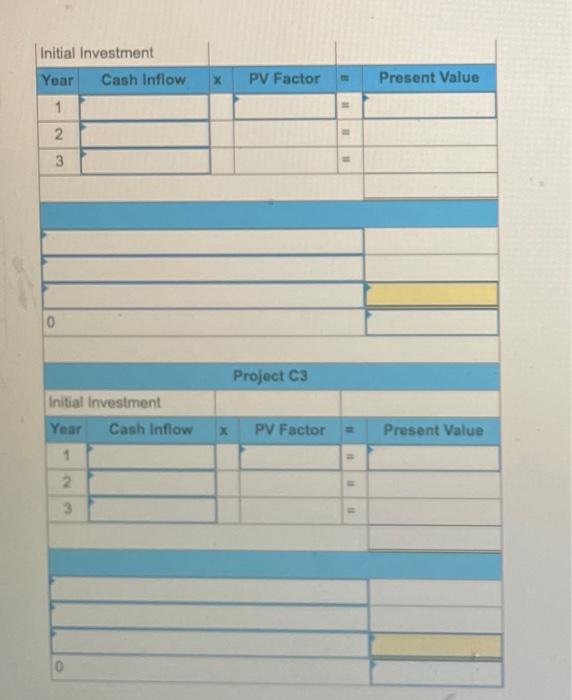

Exercise 24-14 Computation and interpretation of net present value and internal rate of return LO P3, P4 Phoenix Company can Invest in each of three cheese-making projects: C1, C2, and C3. Each project requires an initial Investment of $228,000 and would yield the following annual cash flows. (PVS1. EVO $1. PVA of $1 and EVA of $1 [Use appropriate factors) from the tables provided.) YERE Year Year Total 12.000 108,000 168.000 200.000 02 $ 96,000 36,000 96,000 200,000 03 $100.000 60.000 48.000 9200.000 1. Assume that the company requires a 12% return from its investments. Using not present value determine which projects, if any, should be acquired. (Negative net present values should be indicated with a minus sign. Round your answers to the nearest whole dollar) Project C Investment Chart Values are based on Voor Caen into PV Factor Tour can now Vractor Prosent var 1 2 3 0 Project C2 Initial Investment Year Cash Inflow * PV Factor Present Value 1 2 3 Initial Investment Year Cash Inflow PV Factor Present Value 1 2 3 0 Project C3 Initial Investment Year Cash Inflow PV Factor Present Value 1 2. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts