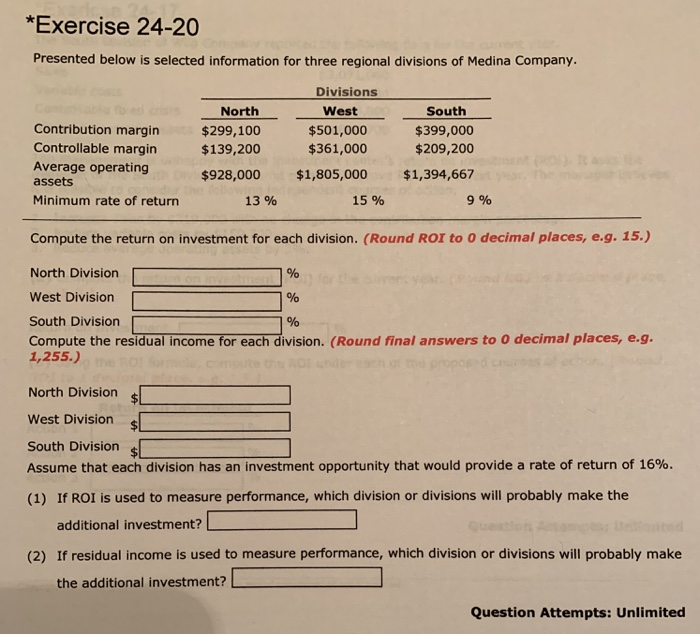

Question: *Exercise 24-20 Presented below is selected information for three regional divisions of Medina Company. Divisions North $299,100 $139,200 $928,000 South $399,000 $209,200 West Contribution margin

*Exercise 24-20 Presented below is selected information for three regional divisions of Medina Company. Divisions North $299,100 $139,200 $928,000 South $399,000 $209,200 West Contribution margin Controllable margin Average operating $501,000 $361,000 $1,805,000$1,394,667 assets Minimum rate of return 13 % 15% 9% Compute the return on investment for each division. (Round ROI to 0 decimal places, e.g. 15.) North Division West Division South Division Compute the residual income for each division. (Round final answers to O decimal places, e.g. 1,255.) 1% North Division West Division South Division Assume that each division has an investment opportunity that would provide a rate of return of 16%. (1) If ROI is used to measure performance, which division or divisions will probably make the additional investment? (2) If residual income is used to measure performance, which division or divisions will probably make the additional investment? Question Attempts: Unlimited

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts