Question: Exercise 24.4 Payback period: accelerated depreciation LO P1 A machine can be purchased for $236,000 and used for five years, yielding the following net incomes.

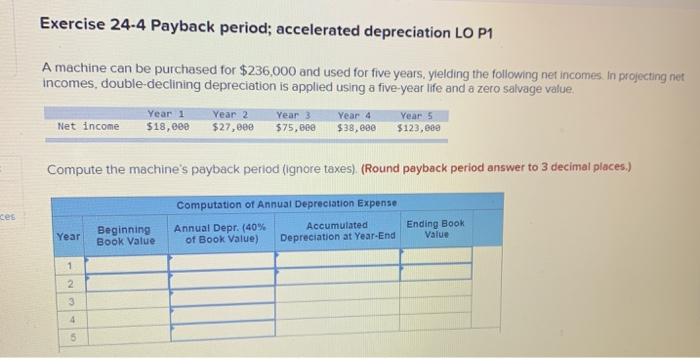

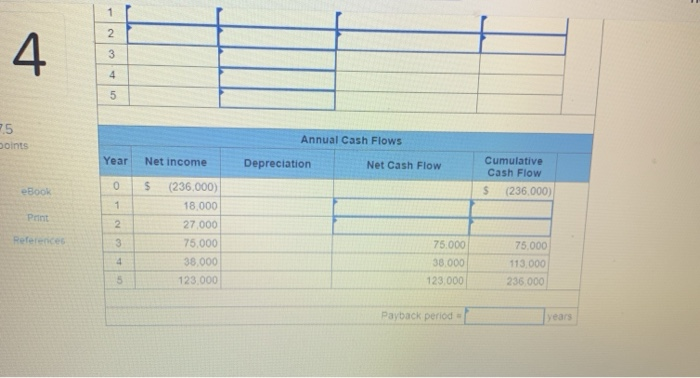

Exercise 24.4 Payback period: accelerated depreciation LO P1 A machine can be purchased for $236,000 and used for five years, yielding the following net incomes. In projecting net incomes, double-declining depreciation is applied using a five-year life and a zero salvage value. Year 1 $18,000 Net income Year 2 $27, e8e Year 3 $75,000 Year 4 $38,000 Year 5 $123,000 Compute the machine's payback period (ignore taxes). (Round payback period answer to 3 decimal places.) ces Computation of Annual Depreciation Expense Annual Depr. (40% Accumulated of Book Value) Depreciation at Year-End Beginning Book Value Ending Book Value Year points Annual Cash Flows Depreciation Net Cash Flow Cumulative Cash Flow $ 236.000) eBook Print Year Net income 0 $ (236,000) 18.000 27.000 75.000 38.000 123.000 75.000 38.000 123.000 75.000 113.000 235.000 Payback period lears

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts