Question: / Exercise 2-5 Analyzing transactions L03,5 William Curtis is a personal finance expert and owns Much Money Consulting. This is his first operation and William

/ Exercise 2-5 Analyzing transactions L03,5 William Curtis is a personal finance expert and owns "Much Money" Consulting. This is his first operation and William has hired you to do his accounting. The following transactions are for the ng of October. : a. On October 2, William Curtis invested $32,600 cash into his business. b. On October 4, purchased $925 of office supplies for cash. e. On October 6, purchased $13,600 of office equipment on credit. d. On October 10, received $3,000 cash as revenue for being a guest on the TV show Ci e. On October 12, paid for the office equipment purchased in the transaction (c). f. On October 16, billed a customer $5,400 for delivering a corporate workshop on investing. : | g- On October 18, paid October's rent for the downtown office with $3,500 cash, h. On October 26, collected cash for all of the account receivable created in the transaction.(f) i. On October 31, withdrew $5,000 cash from the business for a trip to Hawaii.

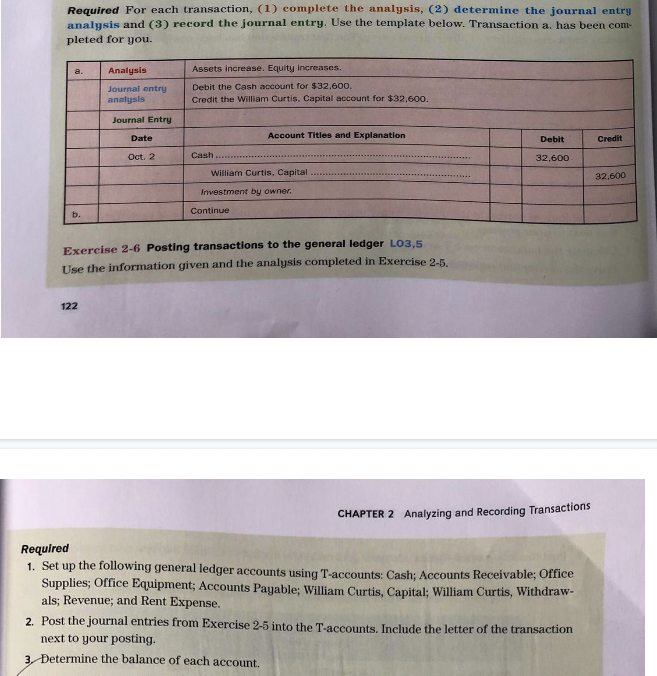

Required For each transaction, (1) complete the analysis, (2) determine the journal entry analysis and (3) record the journal entry. Use the template below. Transaction a. has been com- pleted for you. a. Analysis Assets increase. Equity increases. Journal entry Debit the Cash account for $32,600. analysis Credit the William Curtis, Capital account for $32,600. Journal Entry Date Account Titles and Explanation Debit Credit Oct. 2 32.600 William Curtis, Capital .........mammamasses......... .....49414. 32,600 Investment by owner Continue Exercise 2-6 Posting transactions to the general ledger L03,5 Use the information given and the analysis completed in Exercise 2-5. 122 CHAPTER 2 Analyzing and Recording Transactions Required 1. Set up the following general ledger accounts using T-accounts: Cash; Accounts Receivable; Office Supplies; Office Equipment; Accounts Payable; William Curtis, Capital; William Curtis, Withdraw- als; Revenue; and Rent Expense. 2. Post the journal entries from Exercise 2-5 into the T-accounts. Include the letter of the transaction next to your posting. 3. Determine the balance of each account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts