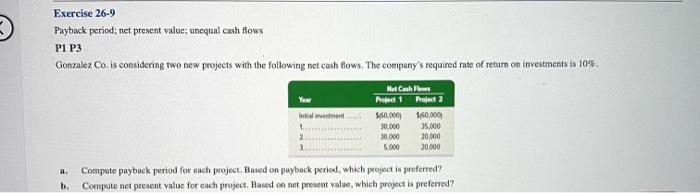

Question: Exercise 26-9 Payback period; net present value; unequal cash flows P1 P3 Gonzalez Co. is considering two new projects with the following net cash flows.

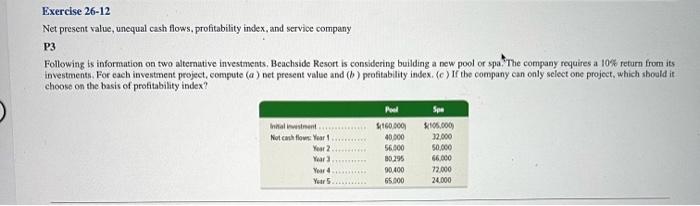

Exercise 26-9 Payback period; net present value; unequal cash flows P1 P3 Gonzalez Co. is considering two new projects with the following net cash flows. The company's required rute of return on investments is 10%. You In investment Nel Cash Flows 1 Project 550,00 50.000 30.000 35.000 30.000 20.000 5.000 20.000 a. Compute payback period for each project. Based on puyback period, which project is preferred Compote not present value for each project. Based on net present value, which project is preferred? b. Exercise 26-12 Net present value, unequal cash flows, profitability index, and service company P3 Following is information on two alternative investments, Beachside Resort is considering building a new pool or spa. The company requires a 10% return from its investments. For each investment project compute (a) net present value and (b) profitability index (c) If the company can only select one project, which should it choose on the basis of profitability index? Pool Spa Intalisten Not cash flow Year Your 2 Year Yeard Year 5 $160.000 40.000 56.000 30.295 90.400 65.000 $105.000 32.000 50.000 66.000 72.000 24.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts