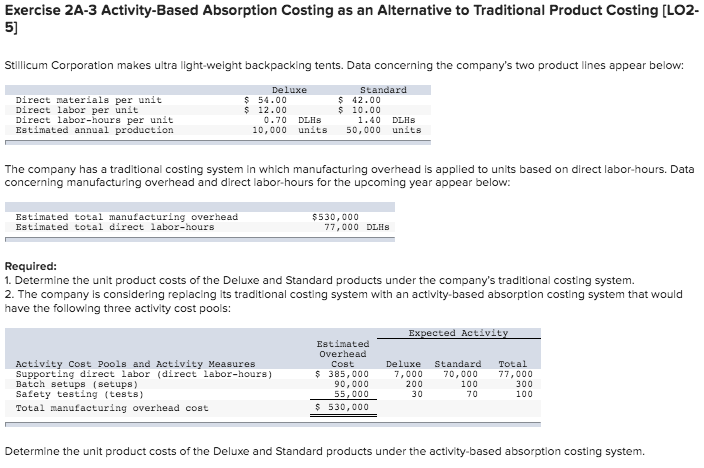

Question: Exercise 2A-3 Activity-Based Absorption Costing as an Alternative to Traditional Product Costing [LO2- 5] Stillicum Corporation makes ultra light weight backpacking tents. Data concerning the

![Costing [LO2- 5] Stillicum Corporation makes ultra light weight backpacking tents. Data](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e312caef434_51466e312ca9179d.jpg)

Exercise 2A-3 Activity-Based Absorption Costing as an Alternative to Traditional Product Costing [LO2- 5] Stillicum Corporation makes ultra light weight backpacking tents. Data concerning the company's two product lines appear below: Deluxe $ 54.00 $ 12.00 0.70 DLHS 10,000 units Direct materials per unit Direct labor per unit Direct labor-hours per unit Estimated annual production $ $ standard 42.00 10.00 1.40 DLHs 50.000 units The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: Estimated total manufacturing overhead Estimated total direct labor-hours $530,000 77,000 DLHS Required: 1. Determine the unit product costs of the Deluxe and Standard products under the company's traditional costing system. 2. The company is considering replacing its traditional costing system with an activity-based absorption costing system that would have the following three activity cost pools: Expected Activity Estimated Overhead Cost $ 385,000 90,000 55,000 $ 530,000 Activity Cost Pools and Activity Measures Supporting direct labor (direct labor-hours) Batch setups (setups) Safety testing (tests) Total manufacturing overhead cost Deluxe Standard 7,000 70,000 100 70 Total 77,000 30 100 Determine the unit product costs of the Deluxe and Standard products under the activity based absorption costing system. Determine the unit product costs of the Deluxe and Standard products under the company's traditional costing system. (Round your intermediate calculations and final answers to 2 decimal places.) Deluxe Standard Unit product cost Determine the unit product costs of the Deluxe and Standard products under the activity-based absorption costing system. (Round your intermediate calculations and final answers to 2 decimal places.). Deluxe Standard Unit product cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts