Question: Exercise 2b: Let us assume this was a fixed-fixed currency swap between the two banks. $1.5 million was the initial instance payment made to Cambridge

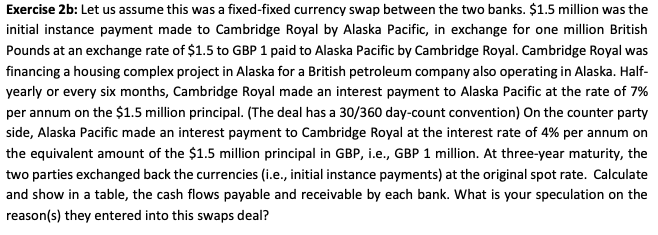

Exercise 2b: Let us assume this was a fixed-fixed currency swap between the two banks. $1.5 million was the initial instance payment made to Cambridge Royal by Alaska Pacific, in exchange for one million British Pounds at an exchange rate of $1.5 to GBP 1 paid to Alaska Pacific by Cambridge Royal. Cambridge Royal was financing a housing complex project in Alaska for a British petroleum company also operating in Alaska. Half- yearly or every six months, Cambridge Royal made an interest payment to Alaska Pacific at the rate of 7% per annum on the $1.5 million principal. (The deal has a 30/360 day-count convention) On the counter party side, Alaska Pacific made an interest payment to Cambridge Royal at the interest rate of 4% per annum on the equivalent amount of the $1.5 million principal in GBP, i.e., GBP 1 million. At three-year maturity, the two parties exchanged back the currencies (i.e., initial instance payments) at the original spot rate. Calculate and show in a table, the cash flows payable and receivable by each bank. What is your speculation on the reason(s) they entered into this swaps deal? Exercise 2b: Let us assume this was a fixed-fixed currency swap between the two banks. $1.5 million was the initial instance payment made to Cambridge Royal by Alaska Pacific, in exchange for one million British Pounds at an exchange rate of $1.5 to GBP 1 paid to Alaska Pacific by Cambridge Royal. Cambridge Royal was financing a housing complex project in Alaska for a British petroleum company also operating in Alaska. Half- yearly or every six months, Cambridge Royal made an interest payment to Alaska Pacific at the rate of 7% per annum on the $1.5 million principal. (The deal has a 30/360 day-count convention) On the counter party side, Alaska Pacific made an interest payment to Cambridge Royal at the interest rate of 4% per annum on the equivalent amount of the $1.5 million principal in GBP, i.e., GBP 1 million. At three-year maturity, the two parties exchanged back the currencies (i.e., initial instance payments) at the original spot rate. Calculate and show in a table, the cash flows payable and receivable by each bank. What is your speculation on the reason(s) they entered into this swaps deal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts