Question: Exercise 3 . 1 You need to create a portfolio to cover the following stream of liabilities for the next six future dates: You may

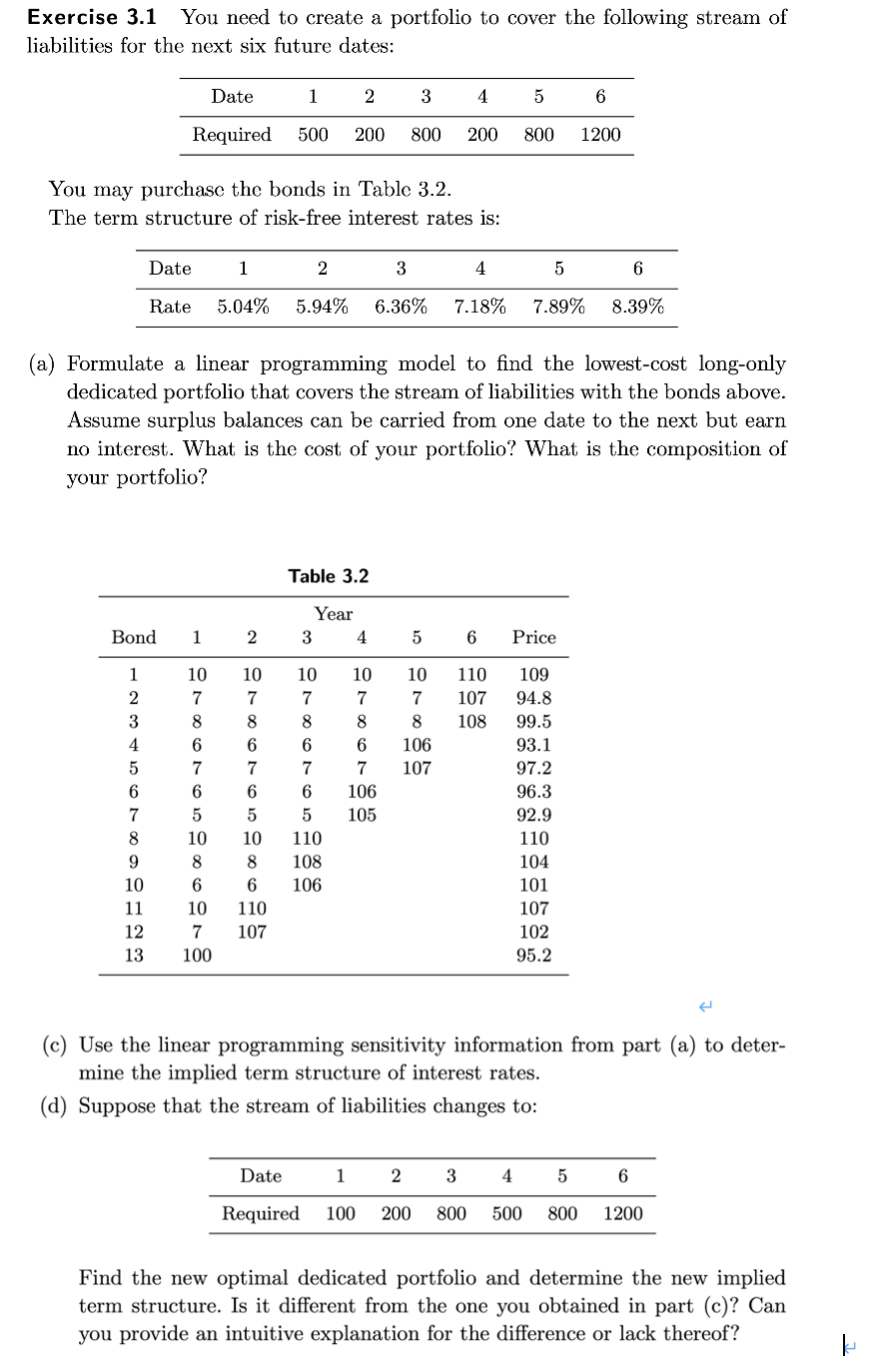

Exercise You need to create a portfolio to cover the following stream of

liabilities for the next six future dates:

You may purchase the bonds in Table

The term structure of riskfree interest rates is:

a Formulate a linear programming model to find the lowestcost longonly

dedicated portfolio that covers the stream of liabilities with the bonds above.

Assume surplus balances can be carried from one date to the next but earn

no interest. What is the cost of your portfolio? What is the composition of

your portfolio?

Table

c Use the linear programming sensitivity information from part a to deter

mine the implied term structure of interest rates.

d Suppose that the stream of liabilities changes to:

Find the new optimal dedicated portfolio and determine the new implied

term structure. Is it different from the one you obtained in part c Can

you provide an intuitive explanation for the difference or lack thereof?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock