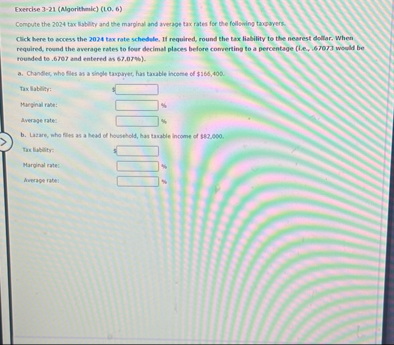

Question: Exercise 3 - 2 1 ( Algorithmic ) ( 1 0 . 6 ) Compute the 2 0 2 4 tax liabilty and the marpinal

Exercise Algorithmic

Compute the tax liabilty and the marpinal and avecage tax rates for the following taxparers.

Click here to access the tax rate schedele. If required, round the tax liability to the nearest dollar. When required, round the average rates to four decimal places before comverting to a percentage ie would be rousded to and entered as

a Chandec, whe fles as a single taspirte, hart tarable income of $

Tre Entilit:

Murginal rase:

Averme rate:

b Lazare, mha files as a head of household, has tarable income of

The liyblity:

Marginal rate:

Arerape ratel

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock