Question: Exercise 3 - 2 6 ( Algorithmic ) ( L 0 . 1 ) Hummingbird Corporation, a closely held C corporation that is not a

Exercise AlgorithmicL

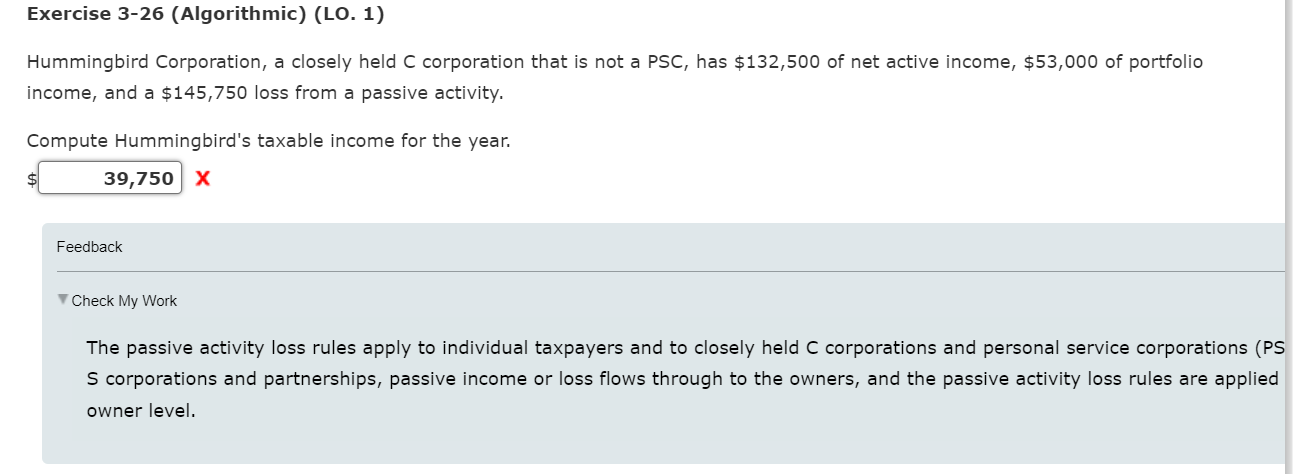

Hummingbird Corporation, a closely held C corporation that is not a PSC has $ of net active income, $ of portfolio

income, and a $ loss from a passive activity.

Compute Hummingbird's taxable income for the year.

$

Feedback

Check My Work

The passive activity loss rules apply to individual taxpayers and to closely held C corporations and personal service corporations PS

corporations and partnerships, passive income or loss flows through to the owners, and the passive activity loss rules are applied

owner level.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock