Question: Exercise 3: Applications (12 points) 1) You are in process of evaluating the effect of interest fluctuation on the profits of First National Bank given

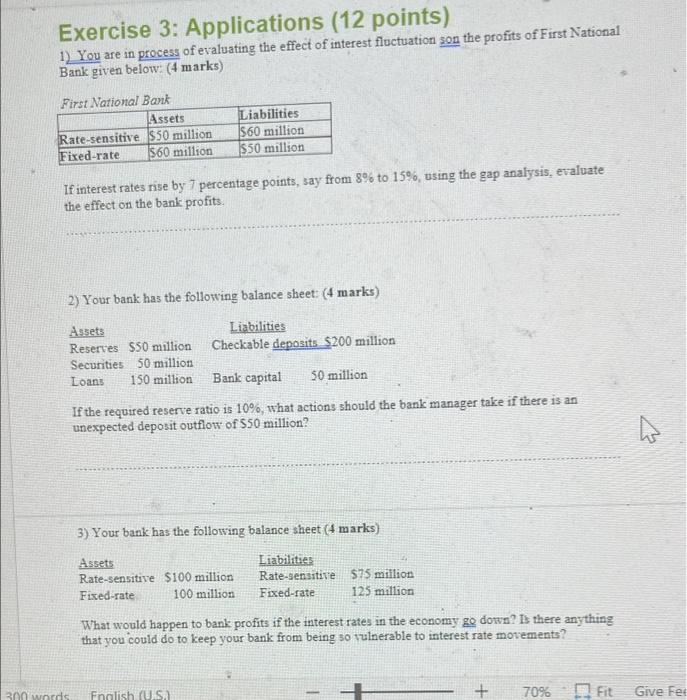

Exercise 3: Applications (12 points) 1) You are in process of evaluating the effect of interest fluctuation on the profits of First National Bank given below: (4 marks) First National Bank Assets Rate-sensitive $50 million Fixed-rate 1560 million Liabilities $60 million $50 million If interest rates rise by 7 percentage points, say from 8% to 15%, using the gap analysis, evaluate the effect on the bank profits. 2) Your bank has the following balance sheet: (4 marks) Liabilities Checkable deposits $200 million Assets Reserves $50 million Securities 50 million Loans 150 million Bank capital 50 million If the required reserve ratio is 10%, what actions should the bank manager take if there is an unexpected deposit outflow of $50 million? W 3) Your bank has the following balance sheet (4 marks) Assets Rate-sensitive $100 million Fixed-rate 100 million Liabilities Rate-sensitive $75 million Fixed-rate 125 million What would happen to bank profits if the interest rates in the economy go down? Is there anything that you could do to keep your bank from being so vulnerable to interest rate movements? 300 words Fnglish (US) + 70% Fit Give Fet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts