Question: Exercise 3 Bear spread can be created by buying a put option with one strike price X1 and selling a put option with another strike

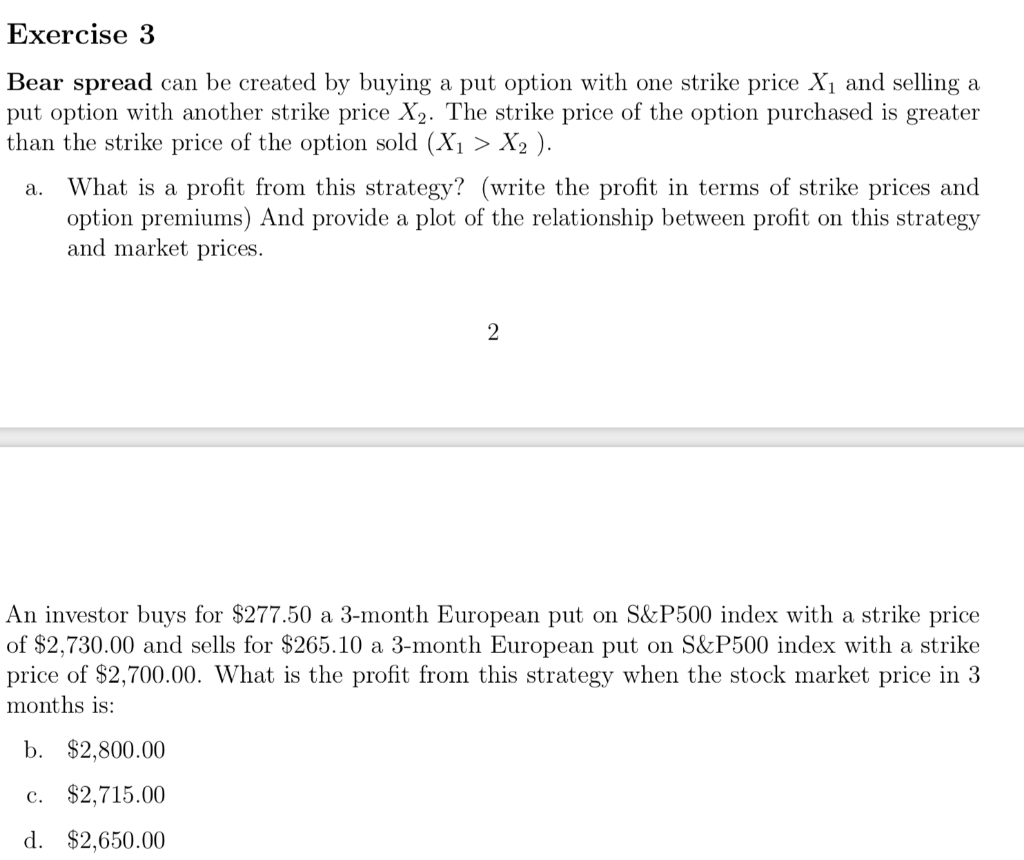

Exercise 3 Bear spread can be created by buying a put option with one strike price X1 and selling a put option with another strike price X2. The strike price of the option purchased is greater than the strike price of the option sold (X1 > X2 ). a. What is a profit from this strategy? (write the profit in terms of strike prices and option premiums) And provide a plot of the relationship between profit on this strategy and market prices. An investor buys for $277.50 a 3-month European put on S&P500 index with a strike price of $2,730.00 and sells for $265.10 a 3-month European put on S&P500 index with a strike price of $2,700.00. What is the profit from this strategy when the stock market price in 3 months is: b. $2,800.00 c. $2,715.00 d. $2,650.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts