Question: Exercise 3: Consider a relationship between a principal and an agent in which an agent's effort influences the result. The principal is risk neutral and

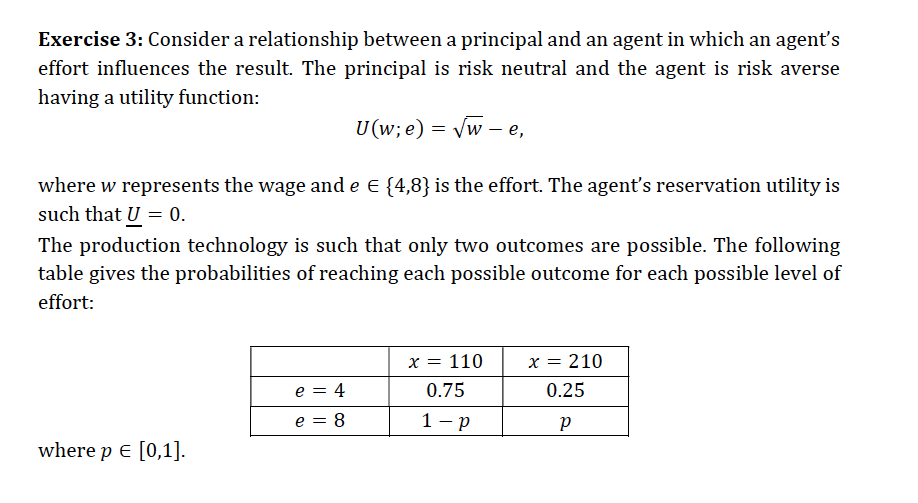

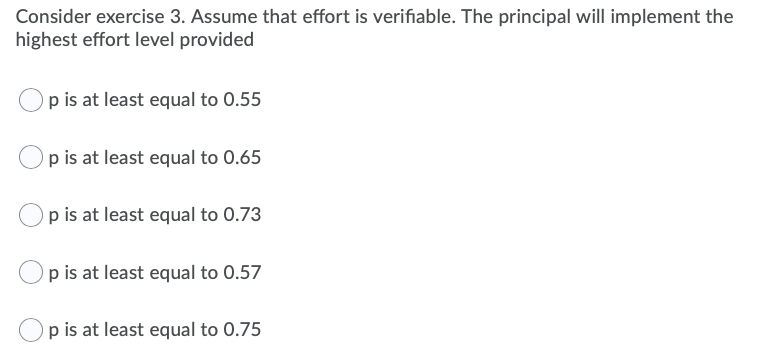

Exercise 3: Consider a relationship between a principal and an agent in which an agent's effort influences the result. The principal is risk neutral and the agent is risk averse having a utility function: U(w;e) = vw - e, where w represents the wage and e E {4,8} is the effort. The agent's reservation utility is such that U = 0. = 0 The production technology is such that only two outcomes are possible. The following table gives the probabilities of reaching each possible outcome for each possible level of effort: x = 110 0.75 x = 210 0.25 e = 4 e = 8 1-p p where p [0,1]. Consider exercise 3. Assume that effort is verifiable. The principal will implement the highest effort level provided p is at least equal to 0.55 p is at least equal to 0.65 p is at least equal to 0.73 p is at least equal to 0.57 p is at least equal to 0.75 Exercise 3: Consider a relationship between a principal and an agent in which an agent's effort influences the result. The principal is risk neutral and the agent is risk averse having a utility function: U(w;e) = vw - e, where w represents the wage and e E {4,8} is the effort. The agent's reservation utility is such that U = 0. = 0 The production technology is such that only two outcomes are possible. The following table gives the probabilities of reaching each possible outcome for each possible level of effort: x = 110 0.75 x = 210 0.25 e = 4 e = 8 1-p p where p [0,1]. Consider exercise 3. Assume that effort is verifiable. The principal will implement the highest effort level provided p is at least equal to 0.55 p is at least equal to 0.65 p is at least equal to 0.73 p is at least equal to 0.57 p is at least equal to 0.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts