Question: Exercise 3 (Exam fall 2021) a) A firm reports net earnings equal to 150 . Only one financial item is reported on the income statement,

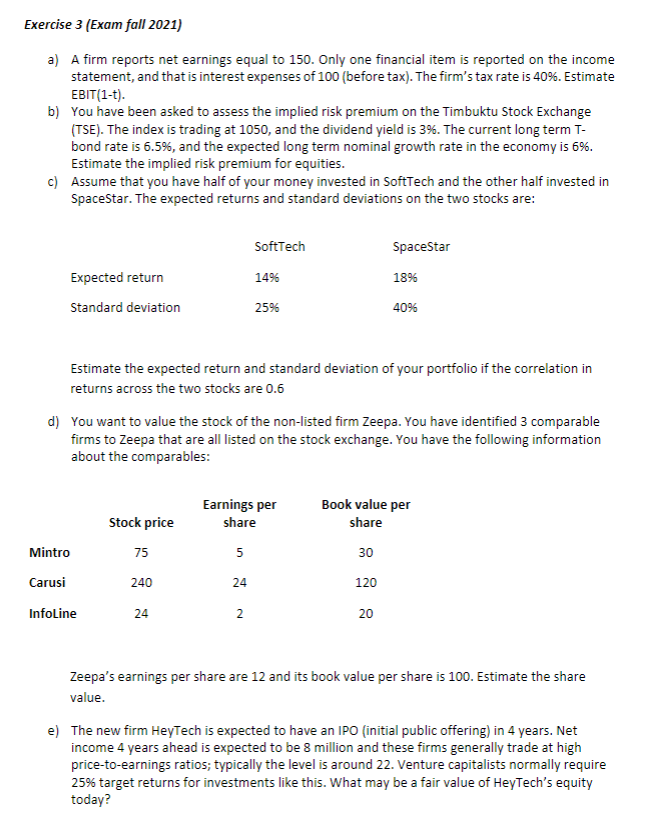

Exercise 3 (Exam fall 2021) a) A firm reports net earnings equal to 150 . Only one financial item is reported on the income statement, and that is interest expenses of 100 (before tax). The firm's tax rate is 40%. Estimate EBIT(1-t). b) You have been asked to assess the implied risk premium on the Timbuktu Stock Exchange (TSE). The index is trading at 1050 , and the dividend yield is 3%. The current long term Tbond rate is 6.5%, and the expected long term nominal growth rate in the economy is 6%. Estimate the implied risk premium for equities. c) Assume that you have half of your money invested in SoftTech and the other half invested in Spacestar. The expected returns and standard deviations on the two stocks are: Estimate the expected return and standard deviation of your portfolio if the correlation in returns across the two stocks are 0.6 d) You want to value the stock of the non-listed firm Zeepa. You have identified 3 comparable firms to Zeepa that are all listed on the stock exchange. You have the following information about the comparables: Zeepa's earnings per share are 12 and its book value per share is 100 . Estimate the share value. e) The new firm HeyTech is expected to have an IPO (initial public offering) in 4 years. Net income 4 years ahead is expected to be 8 million and these firms generally trade at high price-to-earnings ratios; typically the level is around 22 . Venture capitalists normally require 25% target returns for investments like this. What may be a fair value of HeyTech's equity today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts