Question: Exercise #3. For the Exercise #2, you have been asked to evaluate project's standalone risk. You have decided to calculate incremental cash flows for the

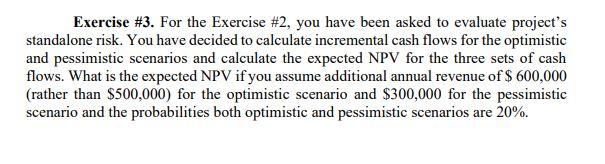

Exercise #3. For the Exercise #2, you have been asked to evaluate project's standalone risk. You have decided to calculate incremental cash flows for the optimistic and pessimistic scenarios and calculate the expected NPV for the three sets of cash flows. What is the expected NPV if you assume additional annual revenue of $ 600,000 (rather than $500,000) for the optimistic scenario and $300,000 for the pessimistic scenario and the probabilities both optimistic and pessimistic scenarios are 20%. Exercise #3. For the Exercise #2, you have been asked to evaluate project's standalone risk. You have decided to calculate incremental cash flows for the optimistic and pessimistic scenarios and calculate the expected NPV for the three sets of cash flows. What is the expected NPV if you assume additional annual revenue of $ 600,000 (rather than $500,000) for the optimistic scenario and $300,000 for the pessimistic scenario and the probabilities both optimistic and pessimistic scenarios are 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts