Question: Exercise 3. Let X be a random variable representing a quantitative daily market dynamic (such as new information about the economy). Suppose that today's stock

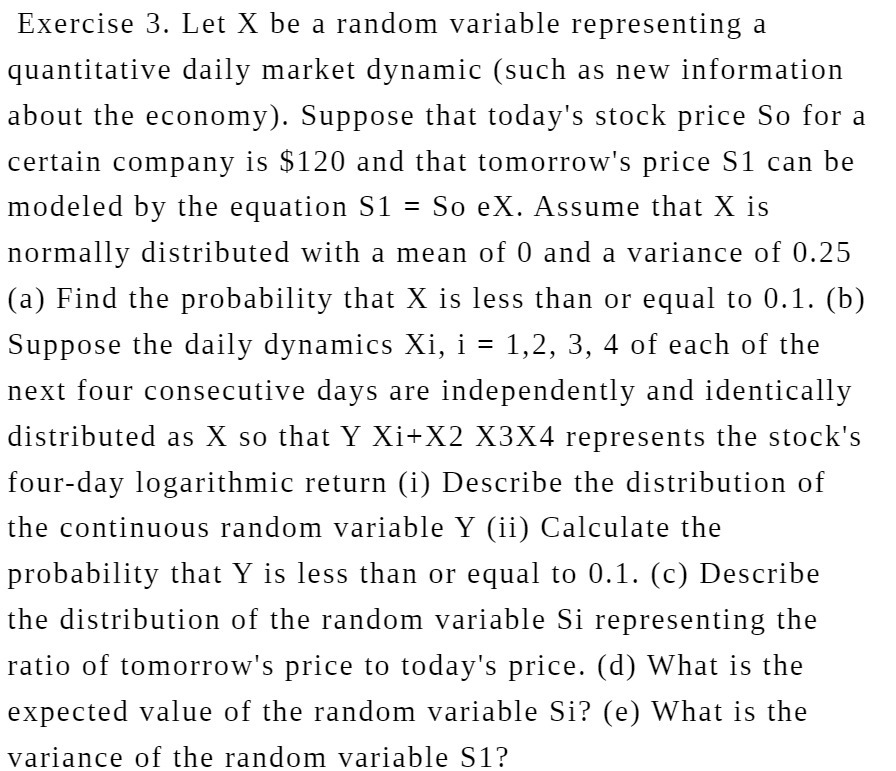

Exercise 3. Let X be a random variable representing a quantitative daily market dynamic (such as new information about the economy). Suppose that today's stock price So for a certain company is $120 and that tomorrow's price 81 can be modeled by the equation Si = So eX. Assume that X is normally distributed with a mean of 0 and a variance of 0.25 (a) Find the probability that X is less than or equal to 0.1. (b) Suppose the daily dynamics Xi, i = 1,2, 3, 4 of each of the next four consecutive days are independently and identically distributed as X so that Y Xi+X2 X3X4 represents the stock's fourday logarithmic return (i) Describe the distribution of the continuous random variable Y (ii) Calculate the probability that Y is less than or equal to 0.1. (c) Describe the distribution of the random variable Si representing the ratio of tomorrow's price to today's price. (d) What is the expected value of the random variable Si? (e) What is the variance of the random variable 81

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts