Question: Exercise 3: Portfolio Beta (3.5 points) You are given the following information for an investment portfolio. i) Calculate the beta of the portfolio? What can

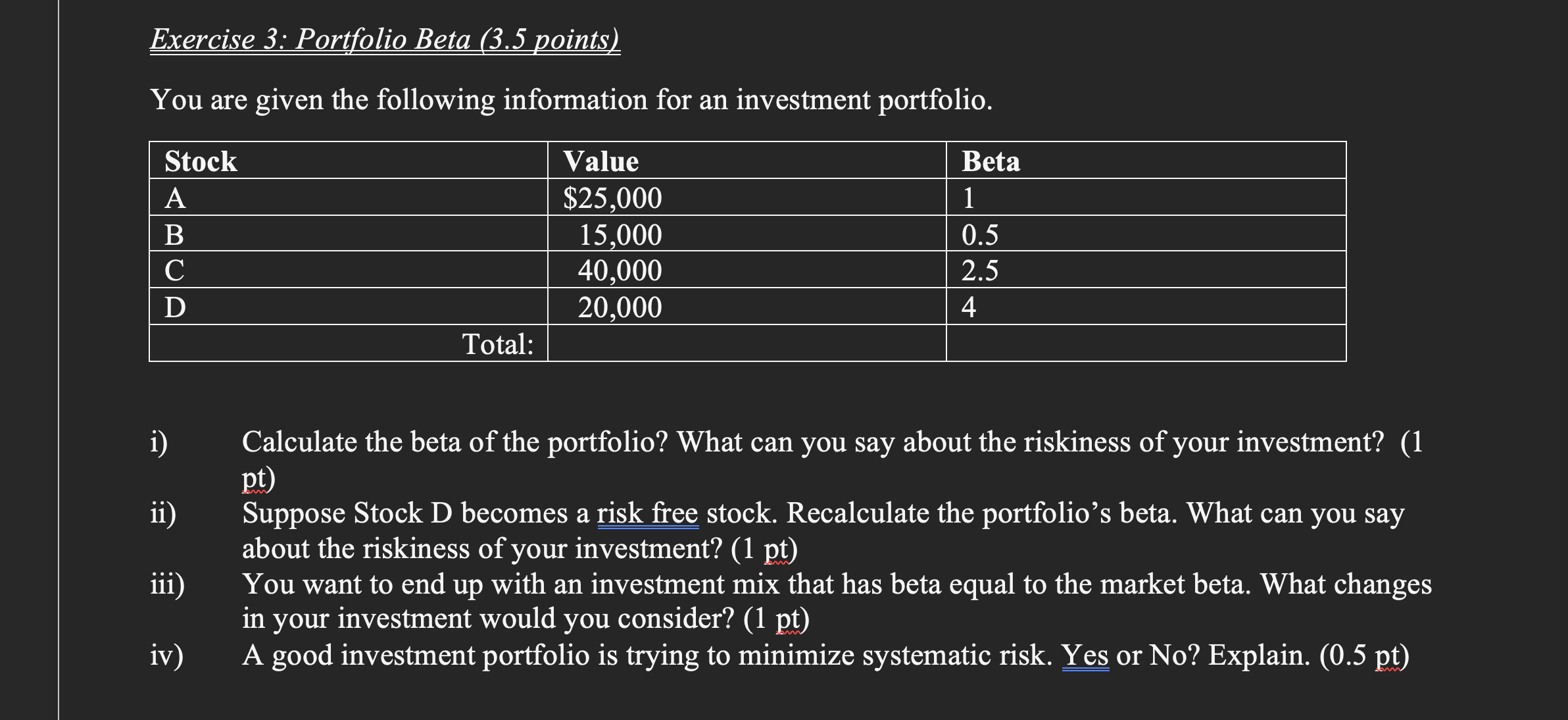

Exercise 3: Portfolio Beta (3.5 points) You are given the following information for an investment portfolio. i) Calculate the beta of the portfolio? What can you say about the riskiness of your investment? (1 pt) ii) Suppose Stock D becomes a risk free stock. Recalculate the portfolio's beta. What can you say about the riskiness of your investment? (1 pt) iii) You want to end up with an investment mix that has beta equal to the market beta. What changes in your investment would you consider? (1 pt) iv) A good investment portfolio is trying to minimize systematic risk. Yes or No? Explain. (0.5 pt) Exercise 3: Portfolio Beta (3.5 points) You are given the following information for an investment portfolio. i) Calculate the beta of the portfolio? What can you say about the riskiness of your investment? (1 pt) ii) Suppose Stock D becomes a risk free stock. Recalculate the portfolio's beta. What can you say about the riskiness of your investment? (1 pt) iii) You want to end up with an investment mix that has beta equal to the market beta. What changes in your investment would you consider? (1 pt) iv) A good investment portfolio is trying to minimize systematic risk. Yes or No? Explain. (0.5 pt)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts