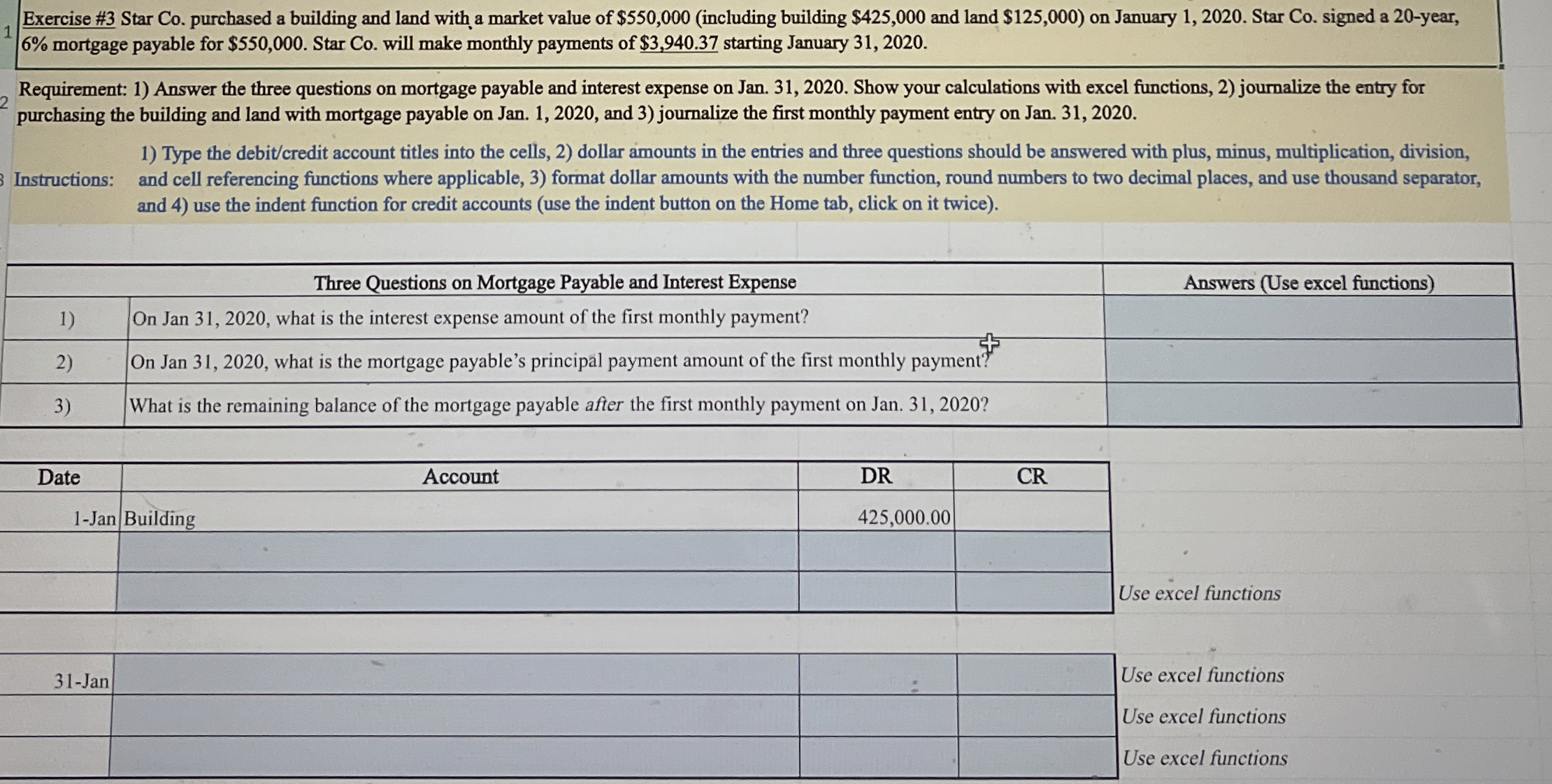

Question: Exercise # 3 Star Co . purchased a building and land with a market value of $ 5 5 0 , 0 0 0 (

Exercise # Star Co purchased a building and land with a market value of $including building $ and land $ on January Star Co signed a year,

mortgage payable for $ Star Co will make monthly payments of $ starting January

Requirement: Answer the three questions on mortgage payable and interest expense on Jan. Show your calculations with excel functions, journalize the entry for

purchasing the building and land with mortgage payable on Jan. and journalize the first monthly payment entry on Jan.

Type the debitcredit account titles into the cells, dollar amounts in the entries and three questions should be answered with plus, minus, multiplication, division,

Instructions:

and cell referencing functions where applicable, format dollar amounts with the number function, round numbers to two decimal places, and use thousand separator,

and use the indent function for credit accounts use the indent button on the Home tab, click on it twice

Use excel functions

Use excel functions

Use excel functions

Use excel functions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock