Question: Exercise 3 Theorem 2.11. (Put-call parity) (Continuous interest is used) Consider the European call and put options with the same exercise price K and exercise

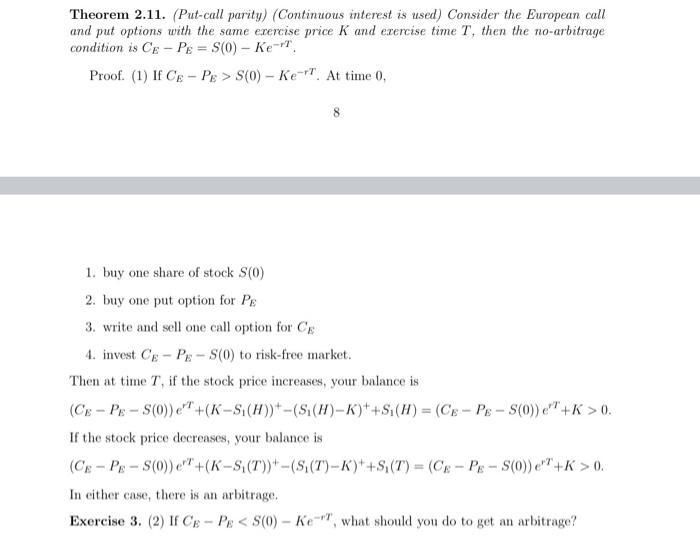

Theorem 2.11. (Put-call parity) (Continuous interest is used) Consider the European call and put options with the same exercise price K and exercise time T, then the no-arbitrage condition is Ce-Pe= S(0) - Ke-7 Proof (1) If Ce-Pe > S(0) - Ke-7. At time 0, 1. buy one share of stock S(O) 2. buy one put option for Pe 3. write and sell one call option for CE 4. invest Cg - Pe -S(O) to risk-free market. Then at time T, if the stock price increases, your balance is (Cs - Pg -S(O))+(K-S (H))-(S(II)-K)++S (H) = (Ce-Pg -S(O))"+K > 0. If the stock price decreases, your balance is (CE-PE -S(O))"+(K-S (T))-(S.(T)-K)*+S(T) = (Ce-Pe-S(O))"+K > 0. In either case, there is an arbitrage, Exercise 3. (2) If Ce-Pe S(0) - Ke-7. At time 0, 1. buy one share of stock S(O) 2. buy one put option for Pe 3. write and sell one call option for CE 4. invest Cg - Pe -S(O) to risk-free market. Then at time T, if the stock price increases, your balance is (Cs - Pg -S(O))+(K-S (H))-(S(II)-K)++S (H) = (Ce-Pg -S(O))"+K > 0. If the stock price decreases, your balance is (CE-PE -S(O))"+(K-S (T))-(S.(T)-K)*+S(T) = (Ce-Pe-S(O))"+K > 0. In either case, there is an arbitrage, Exercise 3. (2) If Ce-Pe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts