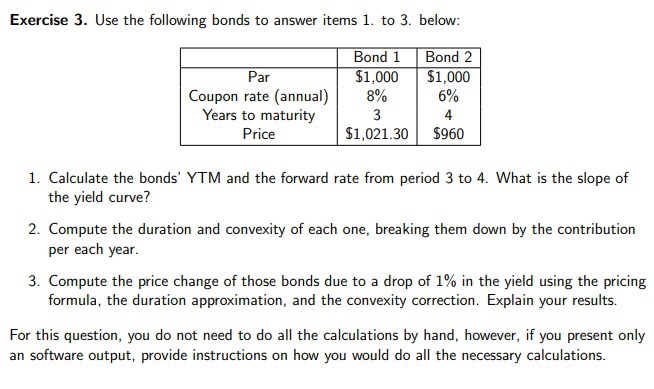

Question: Exercise 3. Use the following bonds to answer items 1. to 3. below: Par Coupon rate (annual) Years to maturity Price Bond 1 $1,000 8%

Exercise 3. Use the following bonds to answer items 1. to 3. below: Par Coupon rate (annual) Years to maturity Price Bond 1 $1,000 8% 3 $1,021.30 Bond 2 $1,000 6% 4 $960 1. Calculate the bonds' YTM and the forward rate from period 3 to 4. What is the slope of the yield curve? 2. Compute the duration and convexity of each one, breaking them down by the contribution per each year. 3. Compute the price change of those bonds due to a drop of 1% in the yield using the pricing formula, the duration approximation, and the convexity correction. Explain your results. For this question, you do not need to do all the calculations by hand, however, if you present only an software output, provide instructions on how you would do all the necessary calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts