Question: Exercise 3- Valuing a project based on discounted free cash flows in perpetulty A perpetuity is a type of annuity that receives an infinite amount

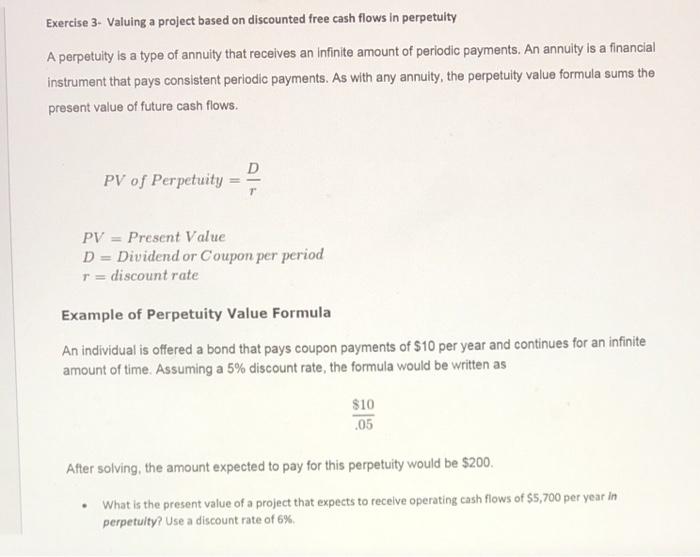

Exercise 3- Valuing a project based on discounted free cash flows in perpetulty A perpetuity is a type of annuity that receives an infinite amount of periodic payments. An annuity is a financial instrument that pays consistent periodic payments. As with any annuity, the perpetuity value formula sums the present value of future cash flows. PV of Perpetuity = ? PV = Present Value D = Dividend or Coupon per period T = discount rate Example of Perpetuity Value Formula An individual is offered a bond that pays coupon payments of S10 per year and continues for an infinite amount of time. Assuming a 5% discount rate, the formula would be written as $10 .05 After solving, the amount expected to pay for this perpetuity would be $200. What is the present value of a project that expects to receive operating cash flows of $5,700 per year in perpetuity? Use a discount rate of 6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts