Question: Exercise 3-12 (Algo) Analyzing and preparing adjusting entries LO P5 Following are two income statements for Alexis Co. for the year ended December 31. The

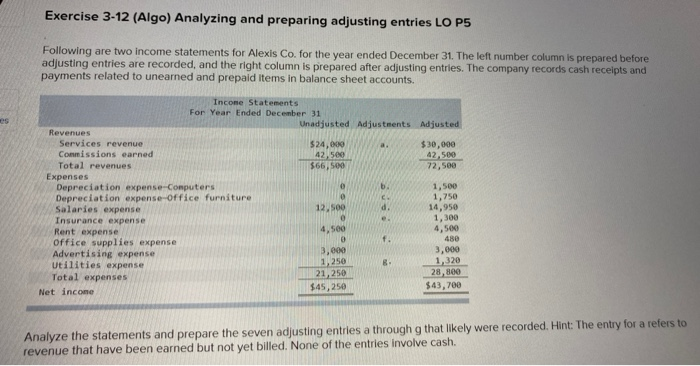

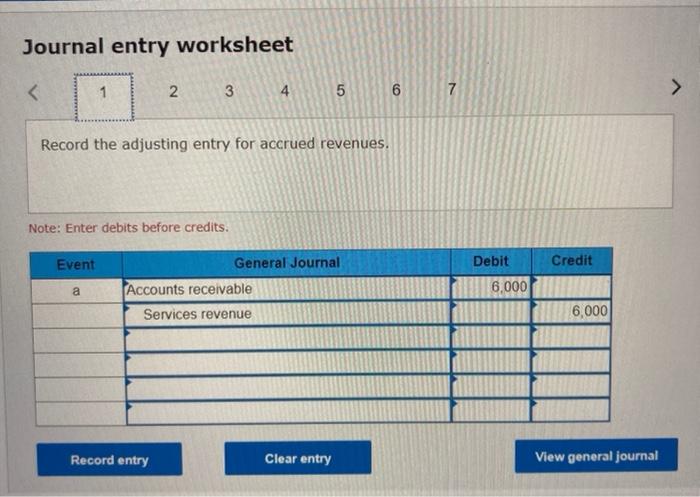

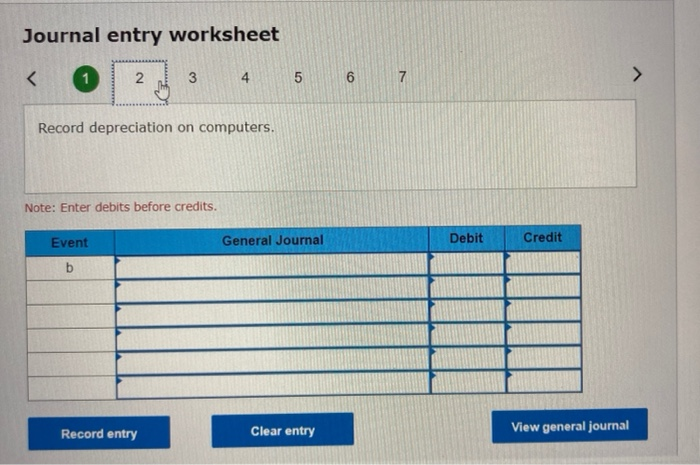

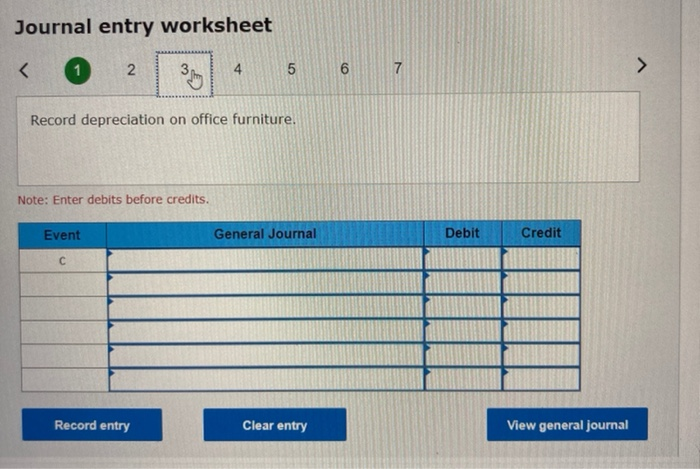

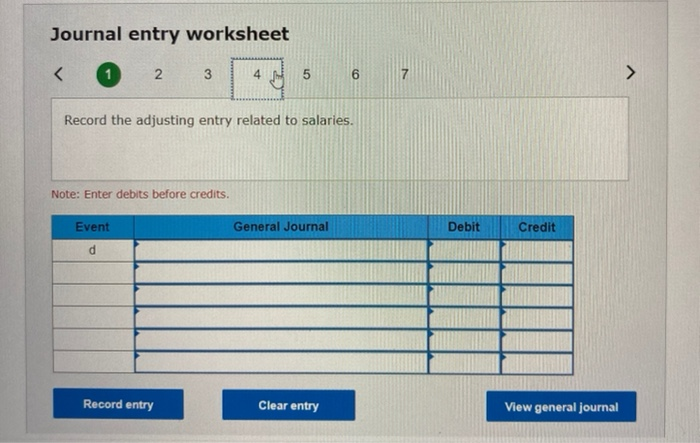

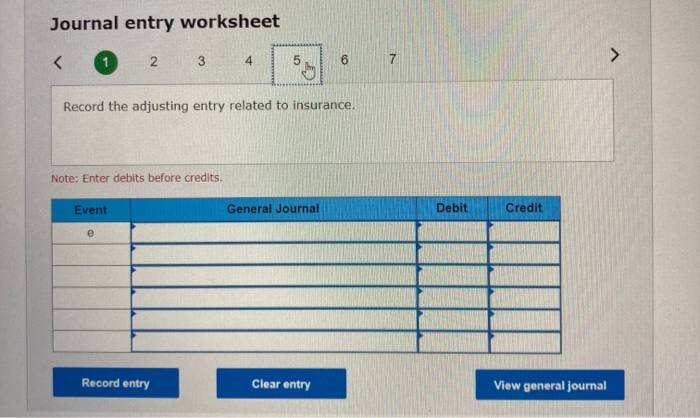

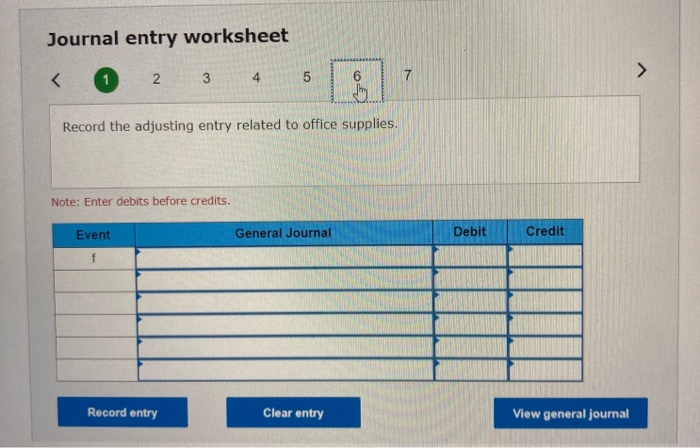

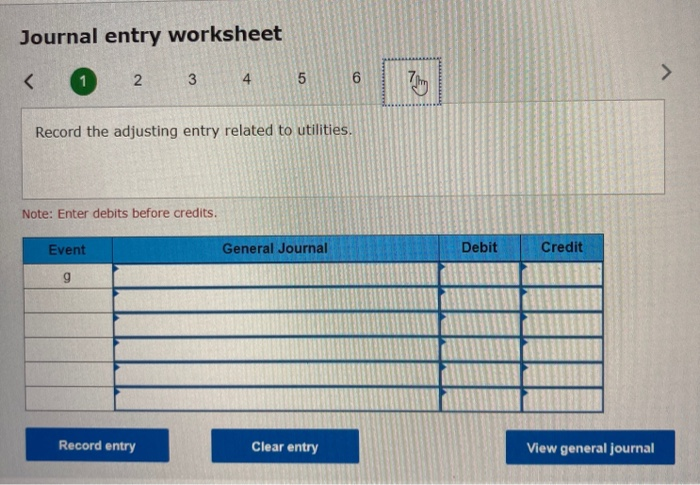

Exercise 3-12 (Algo) Analyzing and preparing adjusting entries LO P5 Following are two income statements for Alexis Co. for the year ended December 31. The left number column is prepared before adjusting entries are recorded, and the right column is prepared after adjusting entries. The company records cash receipts and payments related to unearned and prepaid items in balance sheet accounts. es Income Statements For Year Ended December 31 Revenues Unadjusted Adjustments Adjusted Services revenue $24,000 a. $30,000 Commissions earned 42,500 42,500 Total revenues $66,50 72,500 Expenses Depreciation expense-Computers b. 1,500 Depreciation expense-Office furniture 1,750 Salaries expense 12,500 d. 14,950 Insurance expense 1,300 Rent expense 4,500 office supplies expense f. 480 Advertising expense 3,000 3,000 Utilities expense 1,250 8. 1,320 Total expenses 21,250 28,800 Net income $45,250 $43,700 4,500 Analyze the statements and prepare the seven adjusting entries a through g that likely were recorded. Hint: The entry for a refers to revenue that have been earned but not yet billed. None of the entries involve cash. Journal entry worksheet Record depreciation on computers. Note: Enter debits before credits. Event General Journal Debit Credit b Record entry Clear entry View general journal Journal entry worksheet Record the adjusting entry related to insurance. Note: Enter debits before credits. Event General Journal Debit Credit e Record entry Clear entry View general journal Journal entry worksheet 2 7 Record the adjusting entry related to office supplies. Note: Enter debits before credits. Event General Journal Debit Credit f Record entry Clear entry View general journal Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts