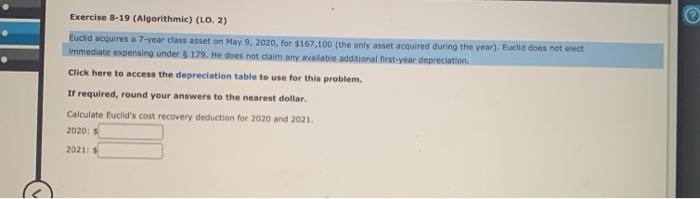

Question: Exercise 3-19 (Algorithmic) (LO. 2) Euclid acquires a 7-year class asset on May 9, 2020, for $167,100 (the only asset acquired during the year). Euclid

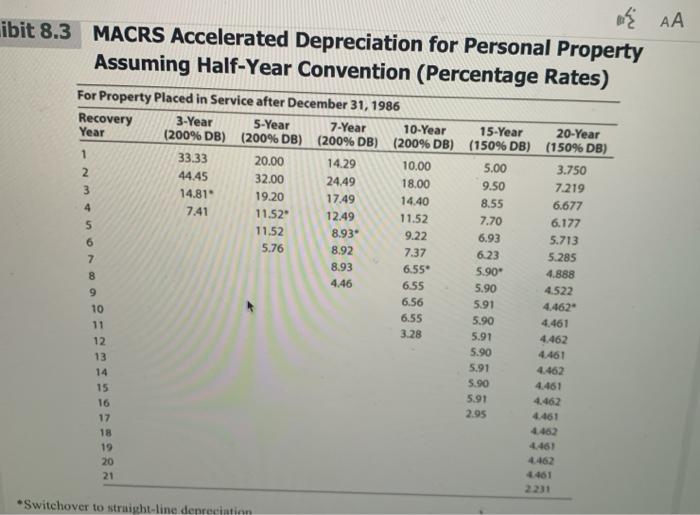

Exercise 3-19 (Algorithmic) (LO. 2) Euclid acquires a 7-year class asset on May 9, 2020, for $167,100 (the only asset acquired during the year). Euclid does not elect Immediate expensing under $ 179. He does not calm any avalable additional first-year depreciation Click here to access the depreciation table to use for this problem. It required, round your answers to the nearest dollar Calculate Euclid's cost recovery deduction for 2020 and 2021 2020: 2021: of AA ibit 8.3 MACRS Accelerated Depreciation for Personal Property Assuming Half-Year Convention (Percentage Rates) For Property Placed in Service after December 31, 1986 Recovery 3-Year 5-Year 7-Year Year 10-Year (200% DB) (200% DB) 15-Year 20-Year (200% DB) (200% DB) (150% DB) (150% DB) 1 33.33 20.00 14.29 10.00 5.00 3.750 2 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81" 19.20 17.49 14.40 8.55 6.677 4 7.41 11.52" 12.49 11.52 7.70 6.177 5 11.52 8.93" 9.22 6.93 5.713 6 5.76 8.92 7.37 6.23 5.285 7 8.93 6.55 5.90 4.888 8 4.46 6.55 5.90 4.522 6,56 5.91 4.462 10 6.55 5.90 4.461 11 3.28 5.91 4.462 12 5.90 4.461 13 5.91 4.462 14 5.90 4.461 15 4.462 16 2.95 4.461 17 18 461 19 20 4461 21 9 5.91 *Switchover to straight-line denreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts