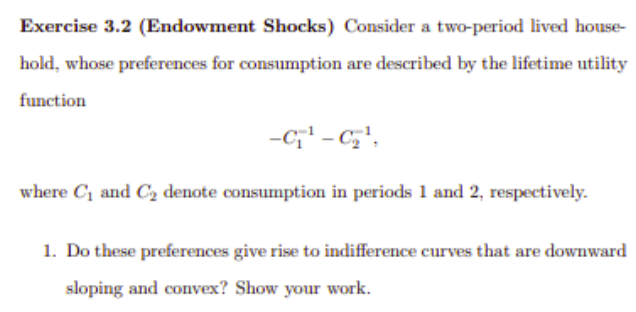

Question: Exercise 3.2 (Endowment Shocks) Consider a two-period lived house- hold, whose preferences for consumption are described by the lifetime utility function where C, and C2

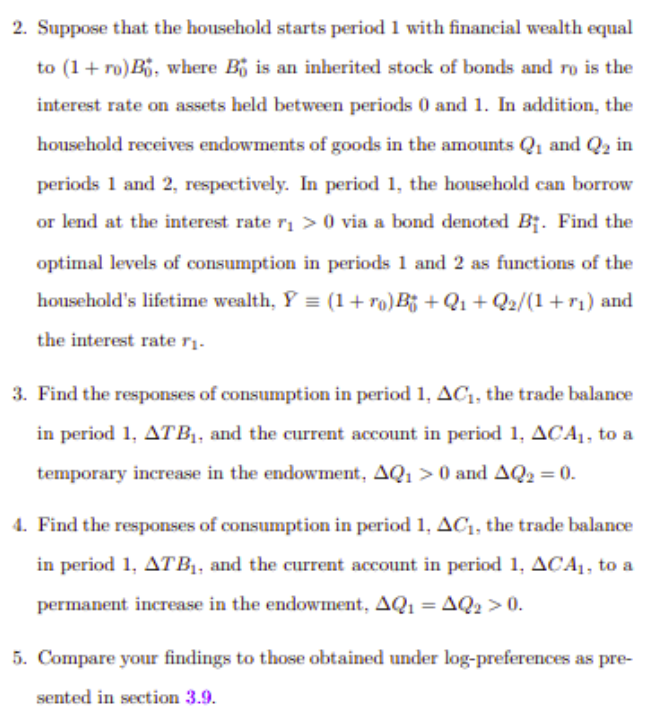

Exercise 3.2 (Endowment Shocks) Consider a two-period lived house- hold, whose preferences for consumption are described by the lifetime utility function where C, and C2 denote consumption in periods 1 and 2, respectively. 1. Do these preferences give rise to indifference curves that are downward sloping and convex? Show your work.2. Suppose that the household starts period 1 with financial wealth equal to (1 + ro) By, where By is an inherited stock of bonds and ro is the interest rate on assets held between periods 0 and 1. In addition, the household receives endowments of goods in the amounts Q, and Q2 in periods 1 and 2, respectively. In period 1, the household can borrow or lend at the interest rate r, > 0 via a bond denoted Be. Find the optimal levels of consumption in periods 1 and 2 as functions of the household's lifetime wealth, Y = (1 + ro) Bi + Q1 + Q2/(1 +r) and the interest rate r1- 3. Find the responses of consumption in period 1, AC, the trade balance in period 1, ATBj, and the current account in period 1, ACA], to a temporary increase in the endowment, AQ1 > 0 and AQ2 = 0. 1. Find the responses of consumption in period 1, AC, the trade balance in period 1, ATBj, and the current account in period 1, ACA,, to a permanent increase in the endowment, AQ1 = AQ, >0. 5. Compare your findings to those obtained under log-preferences as pre- sented in section 3.9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts