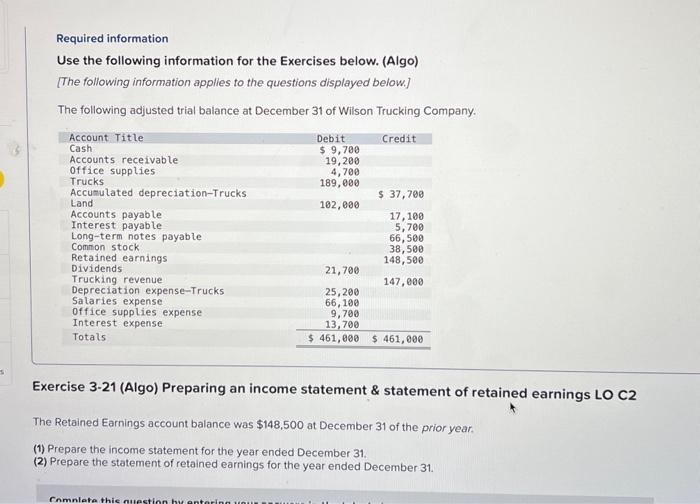

Question: Exercise 3-21 (Algo) Preparing an income statement & statement of retained earnings LO C2 The Retained Earnings account balance was $148,500 at December 31 of

Exercise 3-21 (Algo) Preparing an income statement & statement of retained earnings LO C2

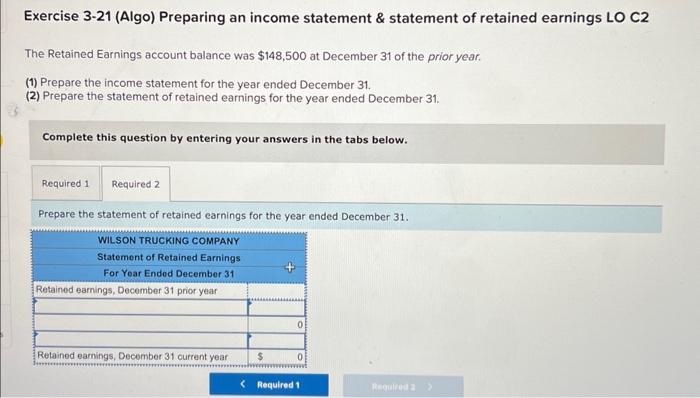

The Retained Earnings account balance was $148,500 at December 31 of the prior year.

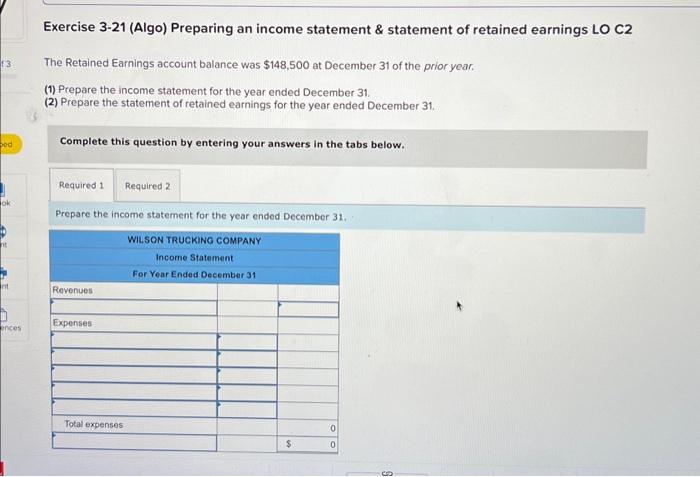

- Prepare the income statement for the year ended December 31.

- Prepare the statement of retained earnings for the year ended December 31.

Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] The following adjusted trial balance at December 31 of Wilson Trucking Company. Exercise 3-21 (Algo) Preparing an income statement \& statement of retained earnings LO C2 The Retained Earnings account balance was $148,500 at December 31 of the prior year. (1) Prepare the income statement for the year ended December 31. (2) Prepare the statement of retained earnings for the year ended December 31. Exercise 3-21 (Algo) Preparing an income statement \& statement of retained earnings LO C2 The Retained Earnings account balance was $148,500 at December 31 of the prior year. (1) Prepare the income statement for the year ended December 31. (2) Prepare the statement of retained earnings for the year ended December 31. Complete this question by entering your answers in the tabs below. Prepare the statement of retained earnings for the year ended December 31 . Exercise 3-21 (Algo) Preparing an income statement \& statement of retained earnings LO C2 The Retained Earnings account balance was $148,500 at December 31 of the prior year. (1) Prepare the income statement for the year ended December 31. (2) Prepare the statement of retained earnings for the year ended December 31. Complete this question by entering your answers in the tabs below. Prepare the income statement for the year ended December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts