Question: Exercise 3-21 (Algorithmic) (LO. 2) Compute the 2023 standard deduction for the following taxpayers. If an amount is zero, enter 0 . Click here

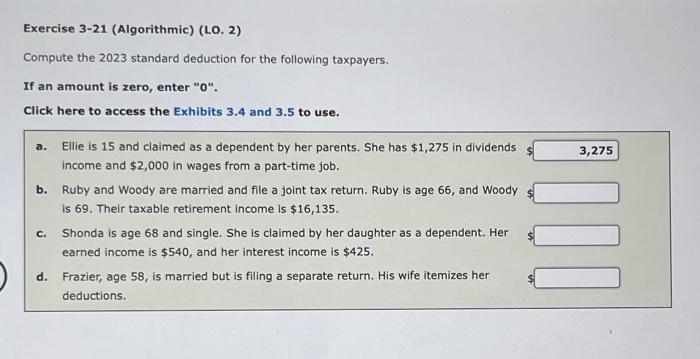

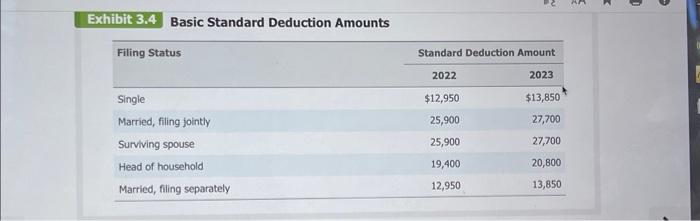

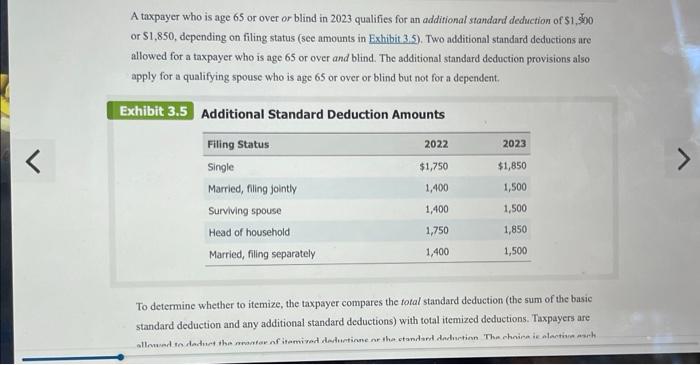

Exercise 3-21 (Algorithmic) (LO. 2) Compute the 2023 standard deduction for the following taxpayers. If an amount is zero, enter " 0 ". Click here to access the Exhibits 3.4 and 3.5 to use. a. Ellie is 15 and claimed as a dependent by her parents. She has $1,275 in dividends income and $2,000 in wages from a part-time job. b. Ruby and Woody are married and file a joint tax return. Ruby is age 66 , and Woody is 69 . Their taxable retirement income is $16,135. c. Shonda is age 68 and single. She is claimed by her daughter as a dependent. Her earned income is $540, and her interest income is $425. d. Frazier, age 58 , is married but is filing a separate return. His wife itemizes her deductions. Basic Standard Deduction Amounts A taxpayer who is age 65 or over or blind in 2023 qualifies for an additional standand deduction of $1,$00 or $1,850, depending on filing status (see amounts in Exhibit 3.5). Two additional standard deductions are allowed for a taxpayer who is age 65 or over and blind. The additional standard deduction provisions also apply for a qualifying spouse who is age 65 or over or blind but not for a dependent. Additional Standard Deduction Amounts To determine whether to itemize, the taxpayer compares the total standard deduction (the sum of the basic standard deduction and any additional standard deductions) with total itemized deductions. Taxpayers are

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts