Question: Exercise 3-25A (Static) Using ratio analysis to assess return on equity LO 3-6 The following information was drawn from the Year 5 balance sheets of

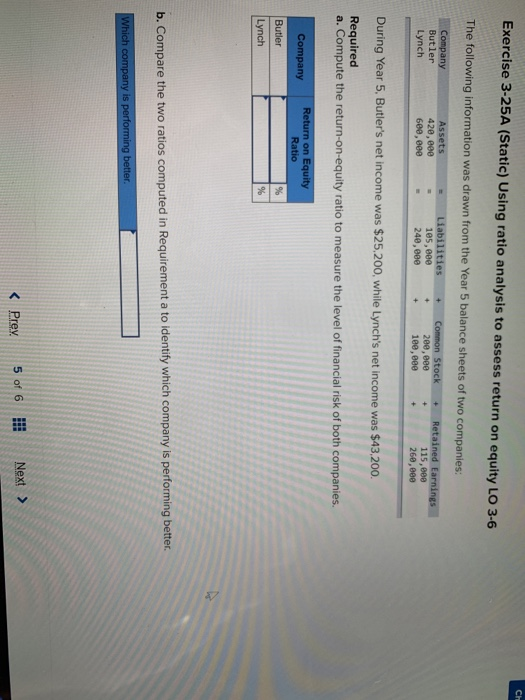

Exercise 3-25A (Static) Using ratio analysis to assess return on equity LO 3-6 The following information was drawn from the Year 5 balance sheets of two companies: + Company Butler Lynch Assets 420,000 6ee, eee Liabilities 105,000 240,000 + + + Common Stock 200,000 1ee, eee + Retained Earnings 115,000 260,000 During Year 5, Butler's net income was $25,200, while Lynch's net income was $43,200. Required a. Compute the return-on-equity ratio to measure the level of financial risk of both companies. Company Return on Equity Ratio % Butler Lynch % b. Compare the two ratios computed in Requirement a to identify which company is performing better. Which company is performing better.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts