Question: Exercise 3-28 (Algorithmic) (LO. 2) Cherry Corporation, a calendar year C corporation, is formed and begins business on 10/1/2020. In connection with its formation, Cherry

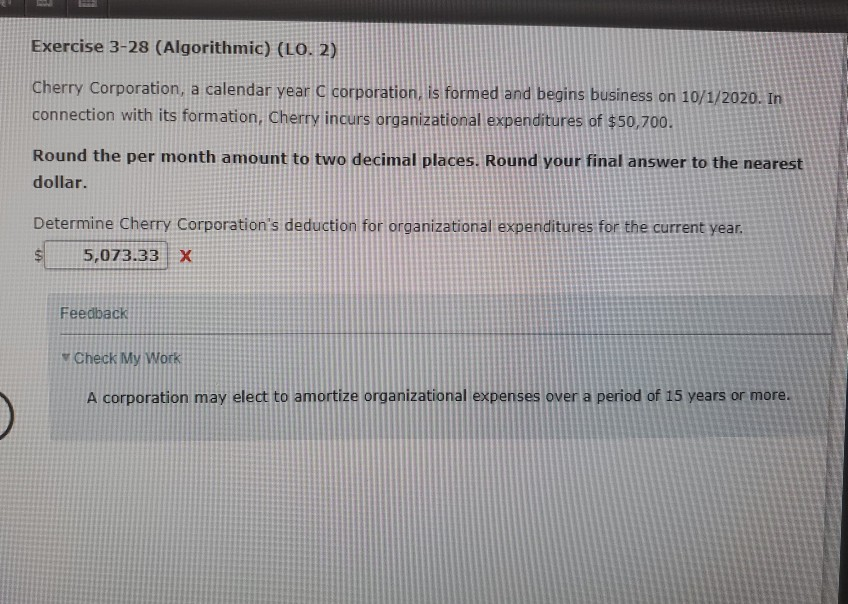

Exercise 3-28 (Algorithmic) (LO. 2) Cherry Corporation, a calendar year C corporation, is formed and begins business on 10/1/2020. In connection with its formation, Cherry incurs organizational expenditures of $50,700. Round the per month amount to two decimal places. Round your final answer to the nearest dollar. Determine Cherry Corporation's deduction for organizational expenditures for the current year. $ 5,073.33 Feedback Check My Work A corporation may elect to amortize organizational expenses over a period of 15 years or more

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts