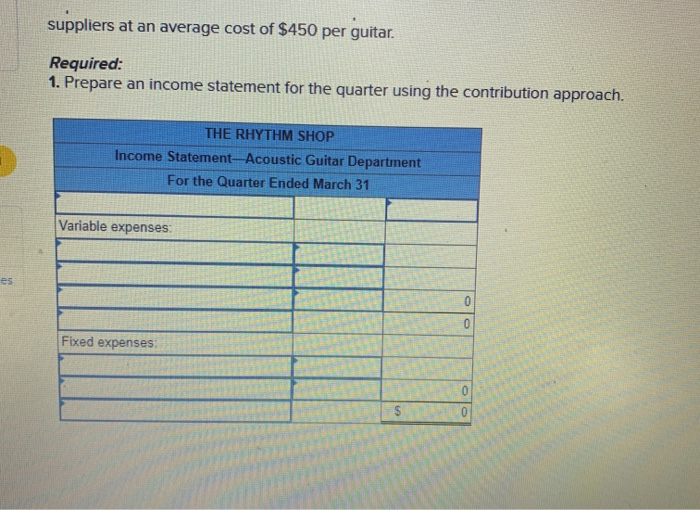

Question: Exercise 3-4 Contribution Format Income Statement [LO3] The Rhythm Shop is a large retailer of acoustic, electric, and bass guitars. An income statement for the

![Exercise 3-4 Contribution Format Income Statement [LO3] The Rhythm Shop is](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e6bef9a5d63_20166e6bef90d6de.jpg)

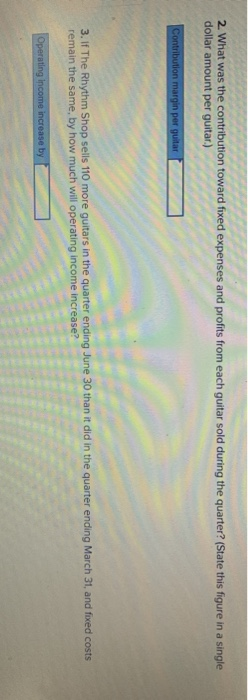

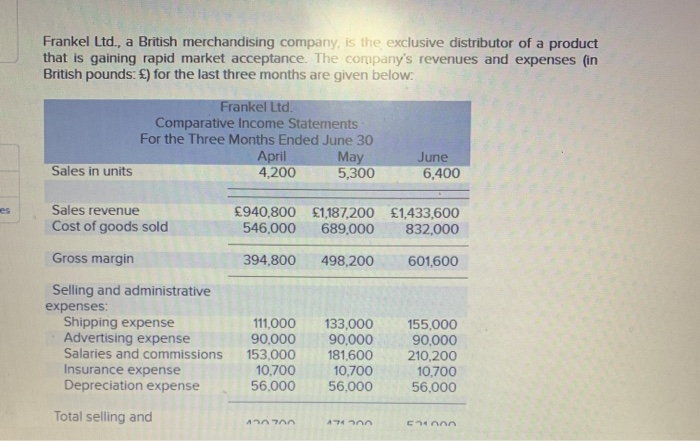

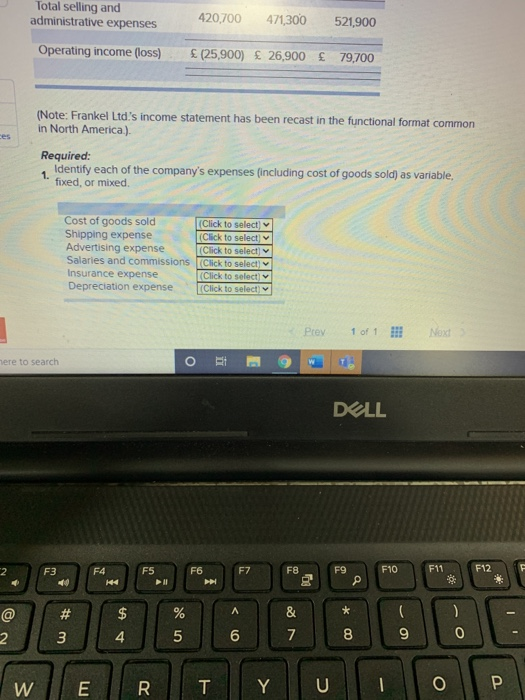

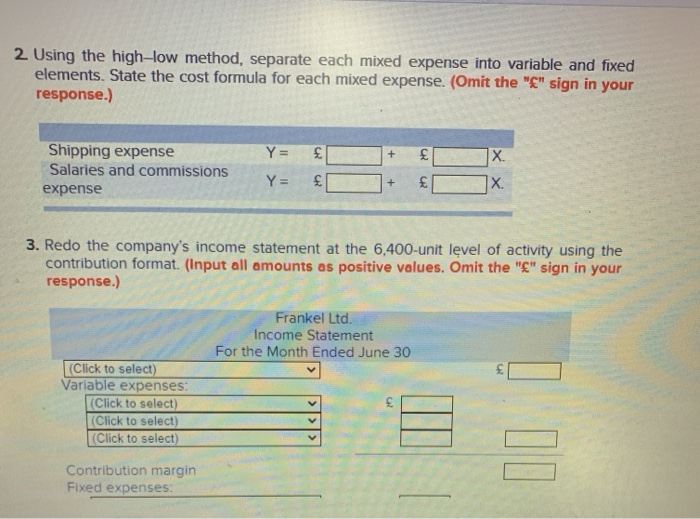

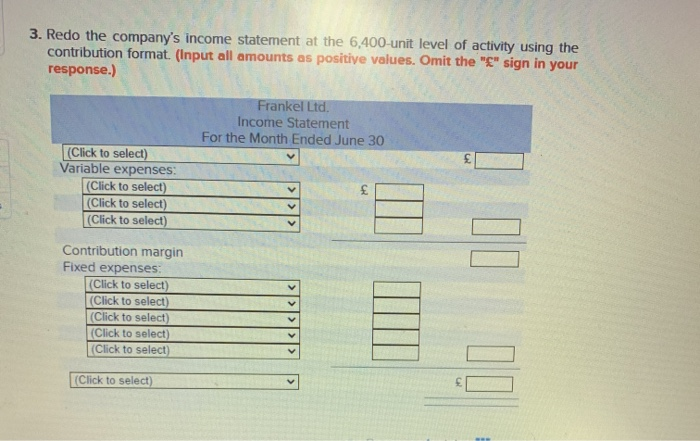

Exercise 3-4 Contribution Format Income Statement [LO3] The Rhythm Shop is a large retailer of acoustic, electric, and bass guitars. An income statement for the company's acoustic guitar department for a recent quarter is presented below. THE RHYTHM SHOP Income Statement-Acoustic Guitar Department For the Quarter Ended March 31 Sales Cost of goods sold $1,785,000 945,000 840,000 Gross margin Selling and administrative expenses Selling expenses Administrative expenses $ 410,000 210,000 620,000 Operating income $ 220,000 The guitars sell, on average, for $850 each. The department's variable selling expenses are $76 per guitar sold. The remaining selling expenses are fixed. The administrative expenses are 20% variable and 80% fixed. The company purchases its guitars from several suppliers at an average cost of $450 per guitar Required: suppliers at an average cost of $450 per guitar. Required: 1. Prepare an income statement for the quarter using the contribution approach. THE RHYTHM SHOP Income Statement Acoustic Guitar Department For the Quarter Ended March 31 Variable expenses es 0 0 Fixed expenses 0 $ 2. What was the contribution toward fixed expenses and profits from each guitar sold during the quarter? (State this figure in a single dollar amount per guitar.) Contribution margin per guitar 3. If The Rhythm Shop sells 110 more guitars in the quarter ending June 30 than it did in the quarter ending March 31, and fixed costs remain the same, by how much will operating income increase? Operating Income increase by Frankel Ltd., a British merchandising company, is the exclusive distributor of a product that is gaining rapid market acceptance. The company's revenues and expenses (in British pounds: ) for the last three months are given below. Frankel Ltd. Comparative Income Statements For the Three Months Ended June 30 April May 4,200 5,300 Sales in units June 6,400 es Sales revenue Cost of goods sold 940,800 $1,187,200 1,433,600 546,000 689,000 832,000 Gross margin 394,800 498,200 601,600 Selling and administrative expenses: Shipping expense Advertising expense Salaries and commissions Insurance expense Depreciation expense 111,000 90,000 153,000 10,700 56,000 133,000 90,000 181,600 10,700 56,000 155,000 90,000 210,200 10,700 56,000 Total selling and 444 An Total selling and administrative expenses 420,700 471,300 521,900 Operating income (loss) (25,900) 26,900 79,700 (Note: Frankel Ltd's income statement has been recast in the functional format common in North America.) Required: Identify each of the company's expenses (including cost of goods sold) as variable. fixed, or mixed 1. Cost of goods sold (Click to select) Shipping expense (Click to select Advertising expense (Click to select Salaries and commissions Click to select Insurance expense (Click to select) Depreciation expense (Click to select Prev 1 of 1 Next here to search O DELL F3 F4 F5 F7 F8 F9 F10 F11 F12 F6 PI & D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts