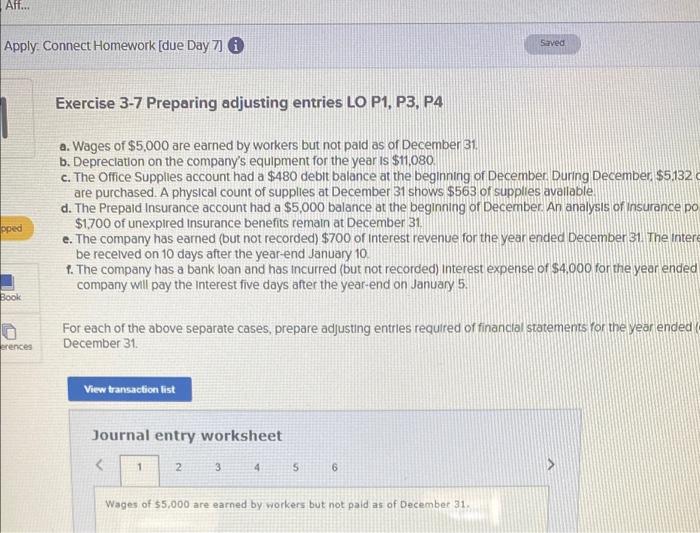

Question: exercise 3-7 preparing adjusting entries LO P1 P3 P4 Aff... Apply Connect Homework [due Day 7] i oped Book 0 erences Exercise 3-7 Preparing adjusting

Aff... Apply Connect Homework [due Day 7] i oped Book 0 erences Exercise 3-7 Preparing adjusting entries LO P1, P3, P4 a. Wages of $5,000 are earned by workers but not paid as of December 31. b. Depreciation on the company's equipment for the year is $11,080. c. The Office Supplies account had a $480 debit balance at the beginning of December. During December, $5.132 are purchased. A physical count of supplies at December 31 shows $563 of supplies available. d. The Prepaid Insurance account had a $5,000 balance at the beginning of December. An analysis of Insurance po $1,700 of unexpired Insurance benefits remain at December 31. e. The company has earned (but not recorded) $700 of Interest revenue for the year ended December 31. The Intere be received on 10 days after the year-end January 10. f. The company has a bank loan and has incurred (but not recorded) Interest expense of $4,000 for the year ended company will pay the Interest five days after the year-end on January 5. For each of the above separate cases, prepare adjusting entries required of financial statements for the year ended December 31. View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts