Question: EXERCISE 3.8 MIT's pension plan has two funds, the fixed income fund and the variable income fund. Let X denote the annual return of the

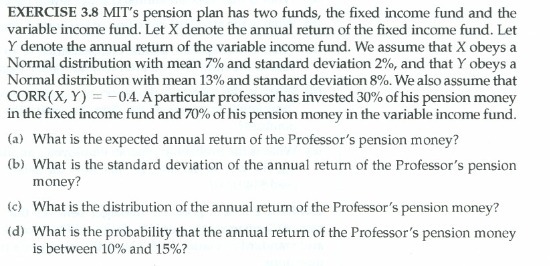

EXERCISE 3.8 MIT's pension plan has two funds, the fixed income fund and the variable income fund. Let X denote the annual return of the fixed income fund. Let Y denote the annual return of the variable income fund. We assume that X obeys a Normal distribution with mean 7% and standard deviation 2%, and that Y obeys a Normal distribution with mean 13% and standard deviation 8%. We also assume that CORR (X, Y) = -0.4. A particular professor has invested 30% of his pension money in the fixed income fund and 70% of his pension money in the variable income fund. (a) What is the expected annual return of the Professor's pension money? (b) What is the standard deviation of the annual return of the Professor's pension money? (c) What is the distribution of the annual return of the Professor's pension money? (d) What is the probability that the annual return of the Professor's pension money is between 10% and 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts