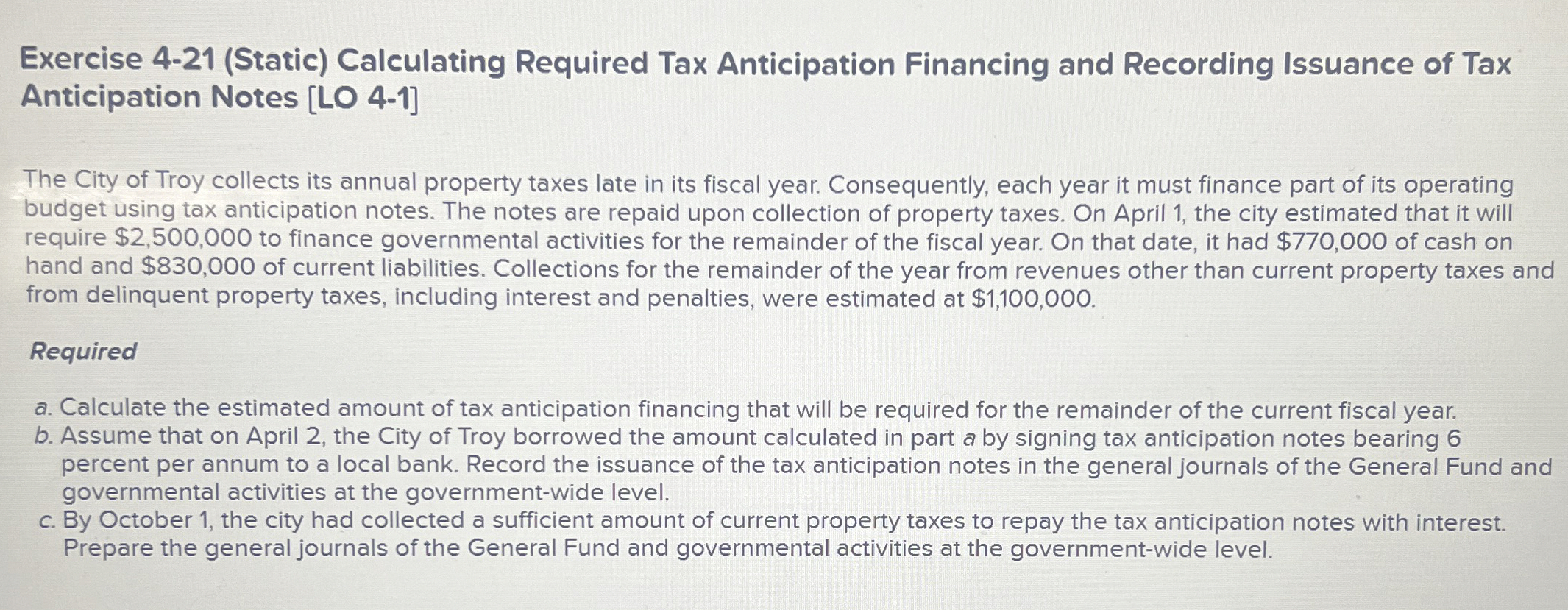

Question: Exercise 4 - 2 1 ( Static ) Calculating Required Tax Anticipation Financing and Recording Issuance of Tax Anticipation Notes [ LO 4 - 1

Exercise Static Calculating Required Tax Anticipation Financing and Recording Issuance of Tax Anticipation Notes LO

The City of Troy collects its annual property taxes late in its fiscal year. Consequently, each year it must finance part of its operating budget using tax anticipation notes. The notes are repaid upon collection of property taxes. On April the city estimated that it will require $ to finance governmental activities for the remainder of the fiscal year. On that date, it had $ of cash on hand and $ of current liabilities. Collections for the remainder of the year from revenues other than current property taxes and from delinquent property taxes, including interest and penalties, were estimated at $

Required

a Calculate the estimated amount of tax anticipation financing that will be required for the remainder of the current fiscal year.

b Assume that on April the City of Troy borrowed the amount calculated in part a by signing tax anticipation notes bearing percent per annum to a local bank. Record the issuance of the tax anticipation notes in the general journals of the General Fund and governmental activities at the governmentwide level.

c By October the city had collected a sufficient amount of current property taxes to repay the tax anticipation notes with interest. Prepare the general journals of the General Fund and governmental activities at the governmentwide level.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock