Question: Exercise 4 - 2 7 ( A l g o ) Operating Transactions and Financial Statements [ L O 4 - 1 , 4 -

Exercise Operating Transactions and Financial Statements

The City Castleton's General Fund had the following postclosing trial balance June the end its fiscal year:

Debits CreditsCash$ Sales Taxes Receivable Taxes ReceivableDelinquent Allowance for Uncollectible Delinquent Taxes $ Interest and Penalties Receivable Allowance for Uncollectible Interest and Penalties Inventory Supplies Vouchers Payable Due Federal Government Deferred Inflows ResourcesUnavailable Revenues Fund BalanceNonspendableInventory Supplies Fund BalanceUnassigned $ $

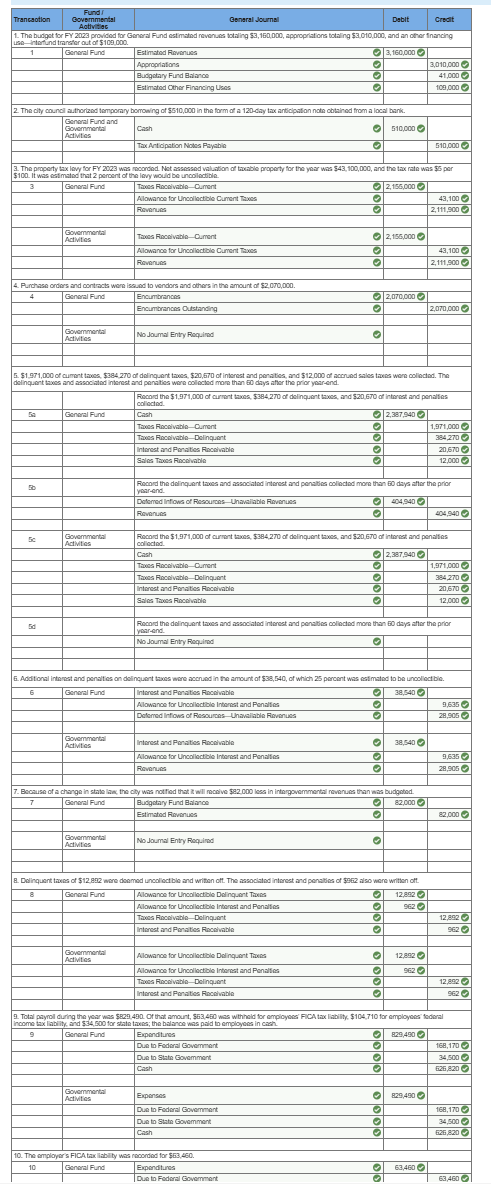

Record the effect the following transactions the General Fund and governmental activities for the year ended June

Record general journal form entries close the budgetary and operating statement accounts the General Fund only.

Prepare a General Fund balance sheet June

Prepare a General Fund statement revenues, expenditures, and changes fund balance for the year ended June

Prepare a General Fund statement revenues, expenditures, and changes fund balance for the year ended June

I NEED HELP WITH PART EVERY OTHER PART CORRECT BUT STRUGGLING FIND WHICH PARTS TOGETHER GET THE CORRECT ANSWER. JUST NEED HELP WITH STATMENT REVENUES, EXPENDITURES, AND CHAGES FUND BLANCE TOOK A SCREEN SHOOT ADDED INTRO BLANACES TEXT

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock