Question: Exercise 4 - 2 7 ( Algo ) Operating Transactions and Financial Statements [ LO 4 - 1 , 4 - 2 , 4 -

Exercise Algo Operating Transactions and Financial Statements LO

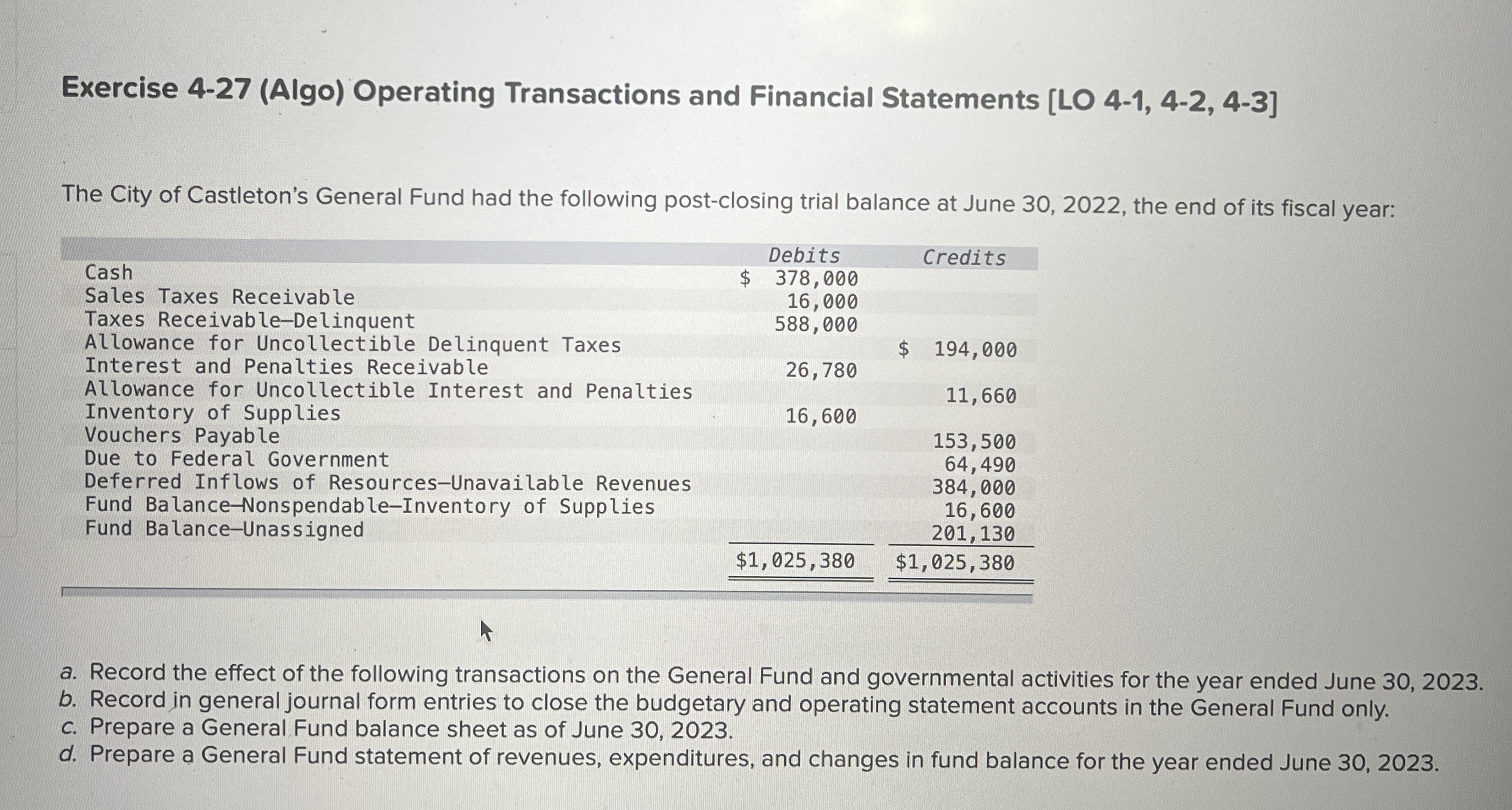

The City of Castleton's General Fund had the following postclosing trial balance at June the end of its fiscal year:

tableDebits,CreditsCash$Sales Taxes Receivable,Taxes ReceivableDelinquent,Allowance for Uncollectible Delinquent Taxes,,,$Interest and Penalties Receivable, $ Allowance for Uncollectible Interest and Penalties,Inventory of SuppliesVouchers Payable,Due to Federal Government,Deferred Inflows of ResourcesUnavailable Revenues,Fund BalanceNonspendableInventory of Supplies,

Fund BalanceUnassigned$$

a Record the effect of the following transactions on the General Fund and governmental activities for the year ended June

b Record in general journal form entries to close the budgetary and operating statement accounts in the General Fund only.

c Prepare a General Fund balance sheet as of June

d Prepare a General Fund statement of revenues, expenditures, and changes in fund balance for the year ended June

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock