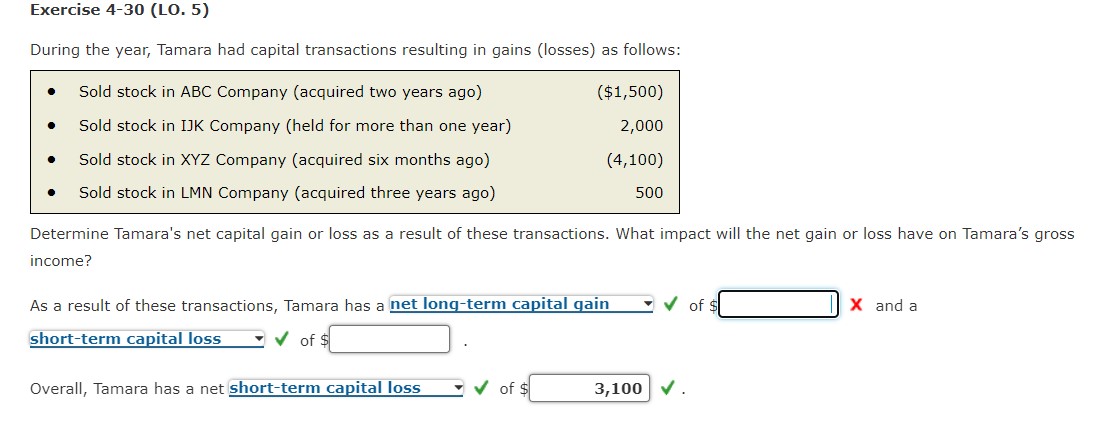

Question: Exercise 4 - 3 0 ( LO . 5 ) During the year, Tamara had capital transactions resulting in gains ( losses ) as follows:

Exercise LO

During the year, Tamara had capital transactions resulting in gains losses as follows:

Sold stock in ABC Company acquired two years ago

Sold stock in IJK Company held for more than one year

Sold stock in XYZ Company acquired six months ago

Sold stock in LMN Company acquired three years ago

Determine Tamara's net capital gain or loss as a result of these transactions. What impact will the net gain or loss have on Tamara's gross

income?

As a result of these transactions, Tamara has a net longterm capital qain of $

and

of $

Overall, Tamara has a net shortterm capital loss of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock