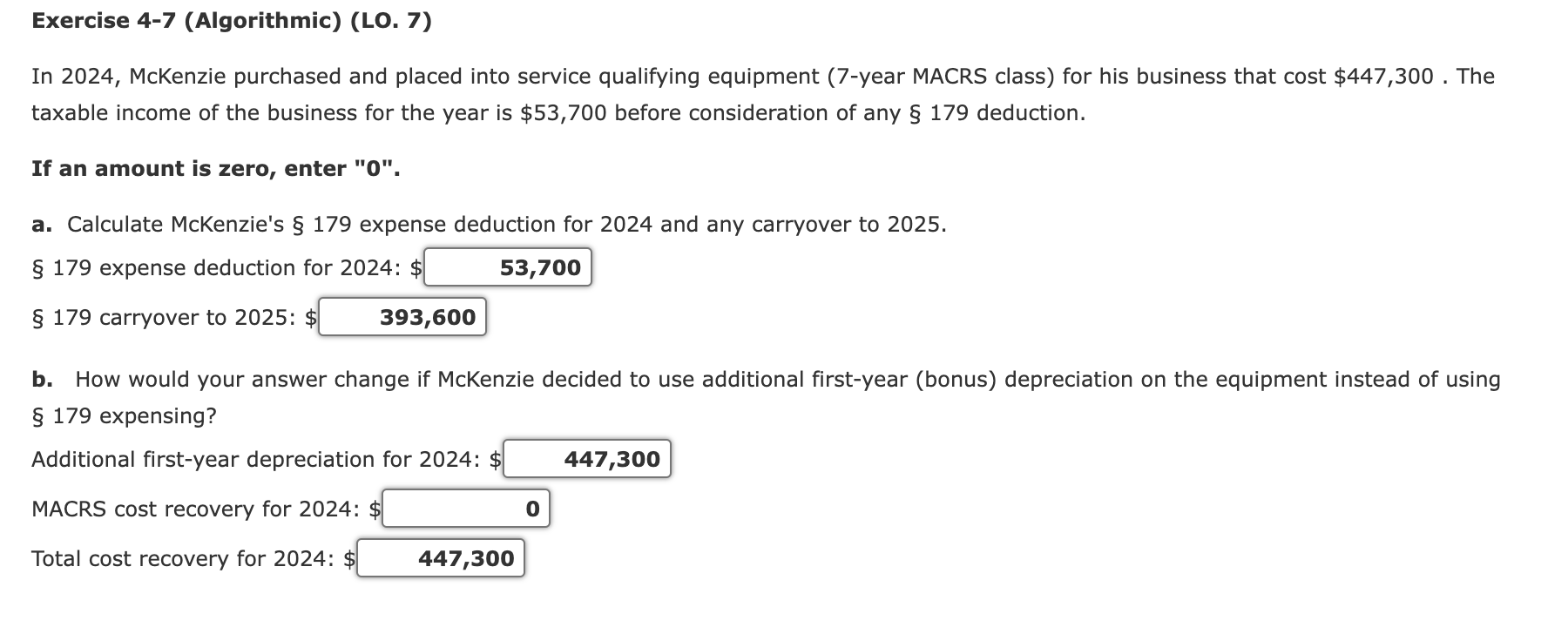

Question: Exercise 4 - 7 ( Algorithmic ) ( LO . 7 ) In 2 0 2 4 , McKenzie purchased and placed into service qualifying

Step by Step Solution

There are 3 Steps involved in it

Problem Analysis and Solution Given Information Equipment cost 447300 Taxable income before 179 5370... View full answer

Get step-by-step solutions from verified subject matter experts