Question: Exercise 4. A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate

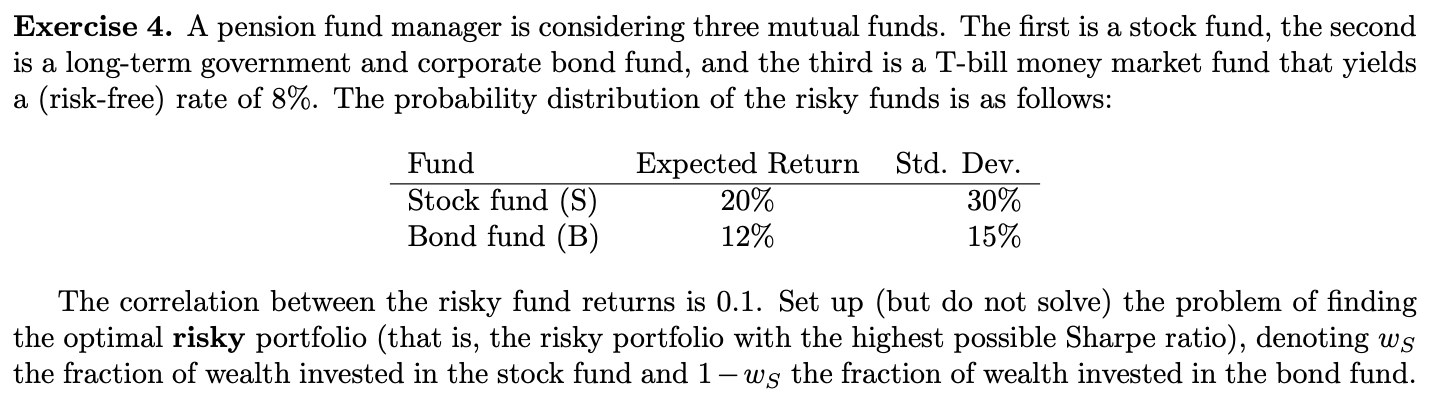

Exercise 4. A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a (risk-free) rate of 8%. The probability distribution of the risky funds is as follows: a Fund Stock fund (S) Bond fund (B) Expected Return 20% 12% Std. Dev. 30% 15% The correlation between the risky fund returns is 0.1. Set up (but do not solve) the problem of finding the optimal risky portfolio (that is, the risky portfolio with the highest possible Sharpe ratio), denoting ws the fraction of wealth invested in the stock fund and 1-ws the fraction of wealth invested in the bond fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts