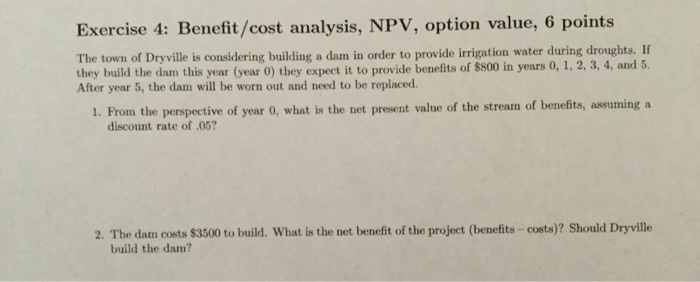

Question: Exercise 4: Benefit/cost analysis, NPV, option value, 6 points The town of Dryville is considering building a dam in order to provide irrigation water during

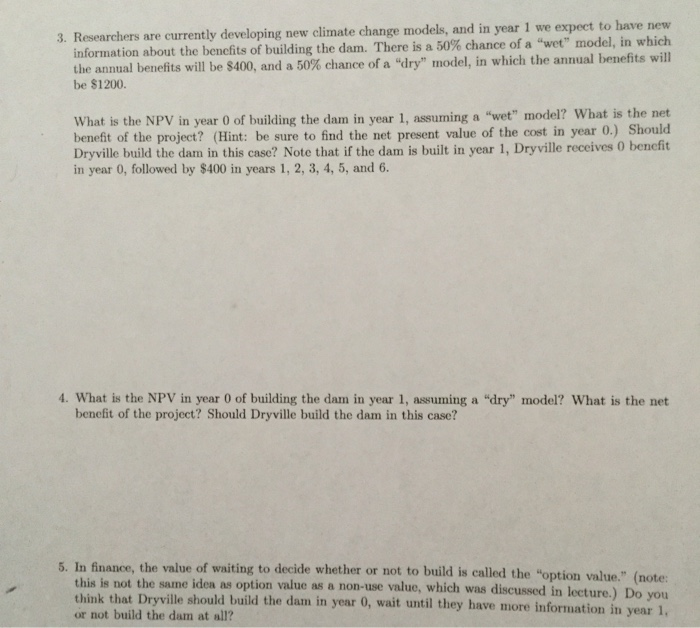

Exercise 4: Benefit/cost analysis, NPV, option value, 6 points The town of Dryville is considering building a dam in order to provide irrigation water during droughts. If they build the dam this year (year 0) they expect it to provide benefits of $800 in years 0, 1, 2, 3, 4, and 5. After year 5, the dam will be worn out and need to be replaced. 1. From the perspective of year 0, what is the net present value of the stream of benefits, assuming a discount rate of .05? 2. The dam costs $3500 to build. What is the net benefit of the project (benefits -costs)? Should Dryville build the dam? 3. Researchers are currently developing new climate change models, and in year 1 we expect to have new information about the benefits of building the dam. There is a 50% chance of a "wet" model, in which the annual benefits will be $400, and a 50% chance of a "dry" model, in which the annual benefits will be $1200. What is the NPV in year 0 of building the dam in year 1, assuming a "wet" model? What is the net benefit of the project? (Hint: be sure to find the net present value of the cost in year 0.) Should Dryville build the dam in this case? Note that if the dam is built in year 1, Dryville receives o benefit in year 0, followed by $400 in years 1, 2, 3, 4, 5, and 6. 4. What is the NPV in year 0 of building the dam in year 1, assuming a "dry" model? What is the net benefit of the project? Should Dryville build the dam in this case? 5. In finance, the value of waiting to decide whether or not to build is called the option value." (note this is not the same idea is option value as a non-use value, which was discussed in lecture.) Do you think that Dryville should build the dam in year 0, wait until they have more information in year 1. or not build the dam at all

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts