Question: EXERCISE 4 Construct 2 0 - year ERM model for valuation of case below. Pear, Inc., a competitor to Apple in the handheld electronic device

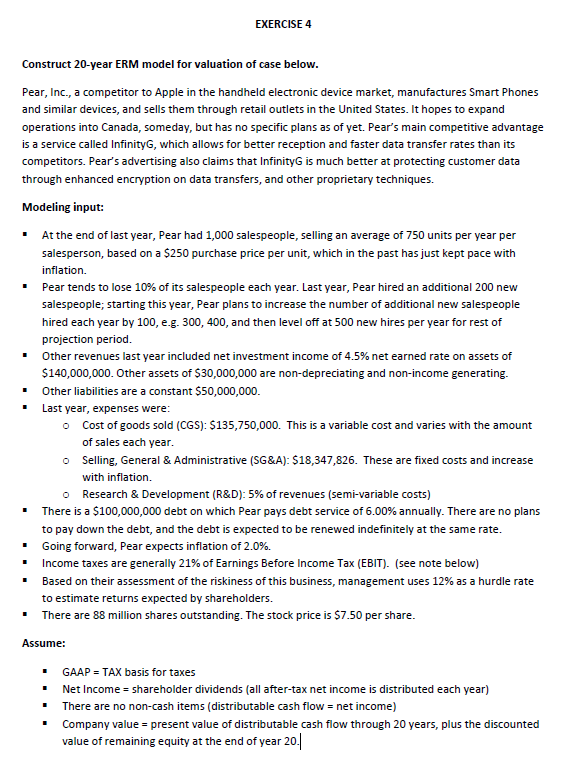

EXERCISE Construct year ERM model for valuation of case below. Pear, Inc., a competitor to Apple in the handheld electronic device market, manufactures Smart Phones and similar devices, and sells them through retail outlets in the United States. It hopes to expand operations into Canada, someday, but has no specific plans as of yet. Pear's main competitive advantage is a service called InfinityG, which allows for better reception and faster data transfer rates than its competitors. Pear's advertising also claims that InfinityG is much better at protecting customer data through enhanced encryption on data transfers, and other proprietary techniques. Modeling input: At the end of last year, Pear had salespeople, selling an average of units per year per salesperson, based on a $ purchase price per unit, which in the past has just kept pace with inflation. Pear tends to lose of its salespeople each year. Last year, Pear hired an additional new salespeople; starting this year, Pear plans to increase the number of additional new salespeople hired each year by eg and then level off at new hires per year for rest of projection period. Other revenues last year included net investment income of net earned rate on assets of $ Other assets of $ are nondepreciating and nonincome generating. Other liabilities are a constant $ Last year, expenses were: Cost of goods sold CGS: $ This is a variable cost and varies with the amount of sales each year. Selling, General & Administrative SG&A: $ These are fixed costs and increase with inflation. Research & Development R&D: of revenues semivariable costs There is a $ debt on which Pear pays debt service of annually. There are no plans to pay down the debt, and the debt is expected to be renewed indefinitely at the same rate. Going forward, Pear expects inflation of Income taxes are generally of Earnings Before Income Tax EBITsee note below Based on their assessment of the riskiness of this business, management uses as a hurdle rate to estimate returns expected by shareholders. There are million shares outstanding. The stock price is $ per share. Assume: GAAP TAX basis for taxes Net Income shareholder dividends all aftertax net income is distributed each year There are no noncash items distributable cash flow net income Company value present value of distributable cash flow through years, plus the discounted value of remaining equity at the end of year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock