Question: Exercise 4 : Expected Return Standard Deviation Assuming the presence of two stocks, A and B , with their characteristics defined as follows: E (

Exercise :

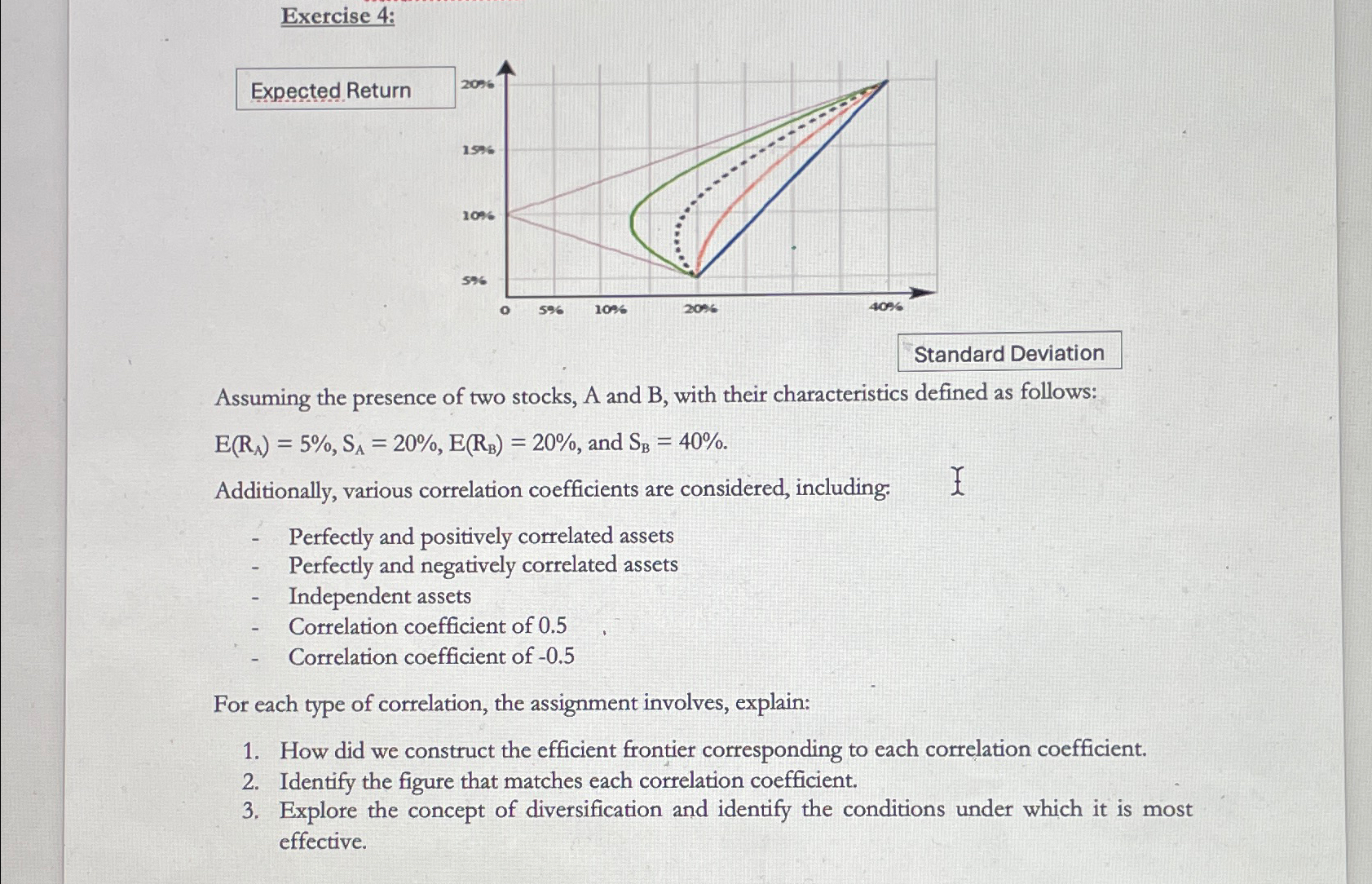

Expected Return

Standard Deviation

Assuming the presence of two stocks, A and with their characteristics defined as follows: and

Additionally, various correlation coefficients are considered, including:

Perfectly and positively correlated assets

Perfectly and negatively correlated assets

Independent assets

Correlation coefficient of

Correlation coefficient of

For each type of correlation, the assignment involves, explain:

How did we construct the efficient frontier corresponding to each correlation coefficient.

Identify the figure that matches each correlation coefficient.

Explore the concept of diversification and identify the conditions under which it is most effective.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock