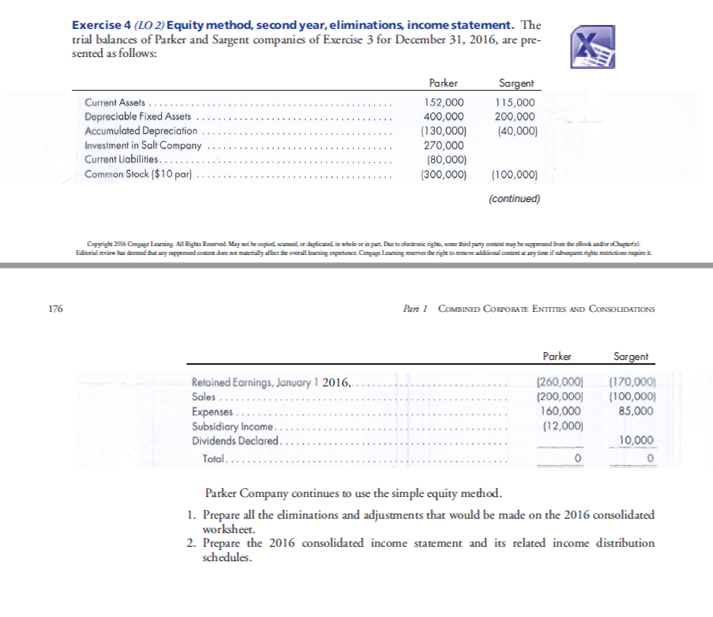

Question: Exercise 4 (LO 2) Equity method, second year, eliminations, income statement. The trial balances of Parker and Sargent companies of Exercise 3 for December 31,

Exercise 4 (LO 2) Equity method, second year, eliminations, income statement. The trial balances of Parker and Sargent companies of Exercise 3 for December 31, 2016, are pre-X sented as follows Parker Current Assets Depreciable Fixed Assets 115,000 200,000 152,000 400,000 130,000 (40,000] 270,000 (80,000) Investment in Salt Company Current Liabilities Common Stock ($10 par 300,000 (100,000) continued) 176 Part1 COMBINED CORORATE ENTITIES AND Parker Sar Retained Earnings, January 1 2016, Sales Expenses Subsidiary Income 260,000 (170,000 200,000 100,000 85,000 160,000 (12,000 10,000 Total Parker Company continues to use the simple equity method worksheet. schedules 1. Prepare all the eliminations and adjustments that would be made on the 2016 consolidated 2. Prepare the 2016 consolidated income statement and its related income distribution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts