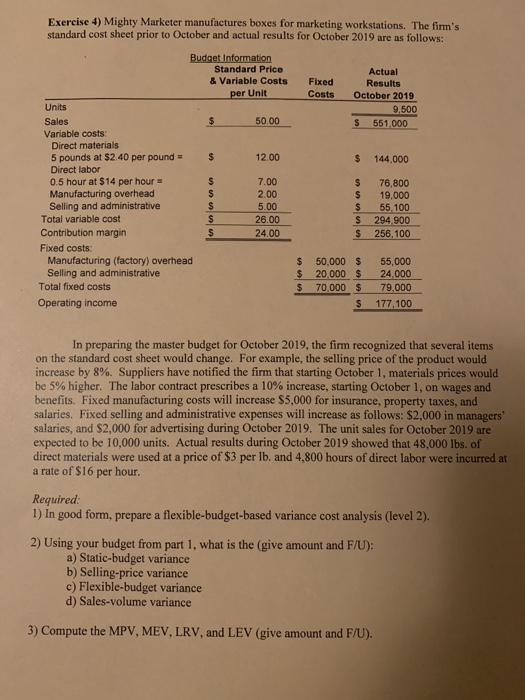

Question: Exercise 4) Mighty Marketer manufactures boxes for marketing workstations. The firm's standard cost sheet prior to October and actual results for October 2019 are as

Exercise 4) Mighty Marketer manufactures boxes for marketing workstations. The firm's standard cost sheet prior to October and actual results for October 2019 are as follows: Actual Fixed Costs October 2019 9,500 $ 551.000 50.00 $ 144,000 Budget Information Standard Price & Variable Costs per Unit Units Sales $ Variable costs Direct materials 5 pounds at $2.40 per pound - $ 12.00 Direct labor 0.5 hour at $14 per hour 7.00 Manufacturing overhead 2.00 Selling and administrative 5.00 Total variable cost 26.00 Contribution margin 24.00 Fixed costs: Manufacturing (factory) overhead Selling and administrative Total fixed costs Operating income $ $ $ $ $ 76,800 19,000 55 100 294,900 256,100 $ $ $ 50,000 $ 20,000 $ 70,000 $ $ 55,000 24,000 79,000 177,100 In preparing the master budget for October 2019, the firm recognized that several items on the standard cost sheet would change. For example, the selling price of the product would increase by 8%. Suppliers have notified the firm that starting October 1, materials prices would be 5% higher. The labor contract prescribes a 10% increase, starting October 1, on wages and benefits. Fixed manufacturing costs will increase $5,000 for insurance, property taxes, and salaries. Fixed selling and administrative expenses will increase as follows: $2,000 in managers salaries, and $2,000 for advertising during October 2019. The unit sales for October 2019 are expected to be 10,000 units. Actual results during October 2019 showed that 48,000 lbs. of direct materials were used at a price of $3 per lb. and 4,800 hours of direct labor were incurred at a rate of $16 per hour. Required: 1) In good form, prepare a flexible-budget-based variance cost analysis (level 2). 2) Using your budget from part 1, what is the (give amount and F/U): a) Static-budget variance b) Selling price variance c) Flexible-budget variance d) Sales-volume variance 3) Compute the MPV, MEV, LRV, and LEV (give amount and F/U)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts