Question: Exercise 4 : Transfer prices and operating income ( 5 marks ) Petromin has two divisions, the transportation division which purchases and transports crude oil,

Exercise : Transfer prices and operating income marks

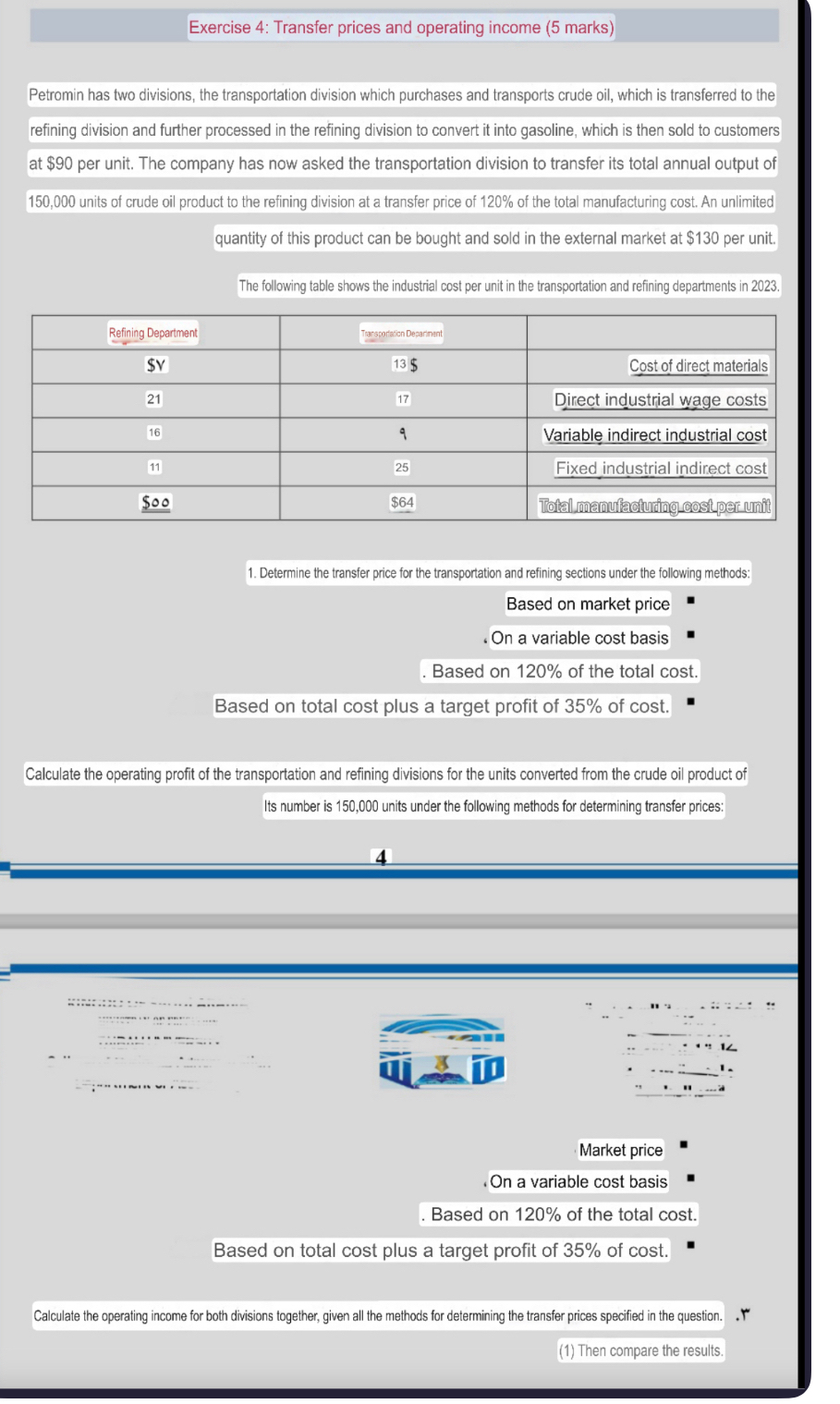

Petromin has two divisions, the transportation division which purchases and transports crude oil, which is transferred to the refining division and further processed in the refining division to convert it into gasoline, which is then sold to customers at $ per unit. The company has now asked the transportation division to transfer its total annual output of units of crude oil product to the refining division at a transfer price of of the total manufacturing cost. An unlimited quantity of this product can be bought and sold in the external market at $ per unit.

The following table shows the industrial cost per unit in the transportation and refining departments in

tableRefining Department,Tarsprataco Devarnat,$ $Cost of direct materialsDirect industrial wage costsVariable indirect industrial costFixed industrial indirect cost$$

Determine the transfer price for the transportation and refining sections under the following methods:

Based on market price

On a variable cost basis

Based on of the total cost.

Based on total cost plus a target profit of of cost

Calculate the operating profit of the transportation and refining divisions for the units converted from the crude oil product of Its number is units under the following methods for determining transfer prices:

Market price

On a variable cost basis

Based on of the total cost.

Based on total cost plus a target profit of of cost

Calculate the operating income for both divisions together, given all the methods for determining the transfer prices specified in the question.

Then compare the results.

Exercise : Transfer prices and operating income marks

Petromin has two divisions, the transportation division which purchases and transports crude oil, which is transferred to the refining division and further processed in the refining division to convert it into gasoline, which is then sold to customers at $ per unit. The company has now asked the transportation division to transfer its total annual output of units of crude oil product to the refining division at a transfer price of of the total manufacturing cost. An unlimited quantity of this product can be bought and sold in the external market at $ per unit.

The following table shows the industrial cost per unit in the transportation and refining departments in

tableRefining Department,Tarsprataco Devarnat,$ $Cost of direct materialsDirect industrial wage costsVariable indirect industrial costFixed industrial indirect cost$$

Determine the transfer price for the transportation and refining sections under the following methods:

Based on market price

On a variable cost basis

Based on of the total cost.

Based on total cost plus a target profit of of cost

Calculate the operating profit of the transportation and refining divisions for the units converted from the crude oil product of Its number is units under the following methods for determining transfer prices:

Market price

On a variable cost basis

Based on of the total cost.

Based on total cost plus a target profit of of cost

Calculate the operating income for both divisions together, given all the methods for determining the transfer prices specified in the question.

Then compare the results.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock