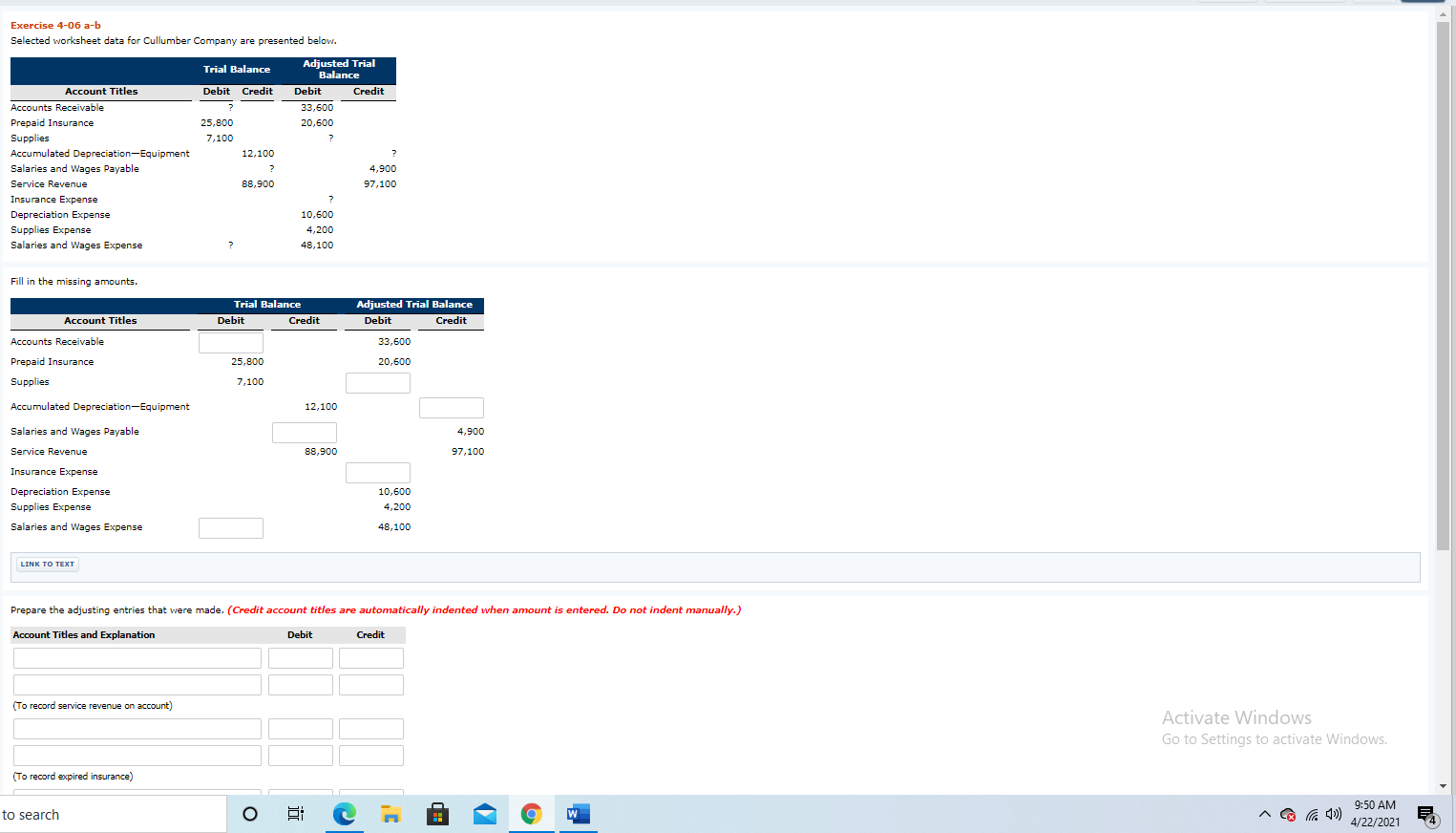

Question: Exercise 4-06 a-b Selected worksheet data for Cullumber Company are presented below. Trial Balance Debit Credit ? 25,800 7,100 12,100 Adjusted Trial Balance Debit Credit

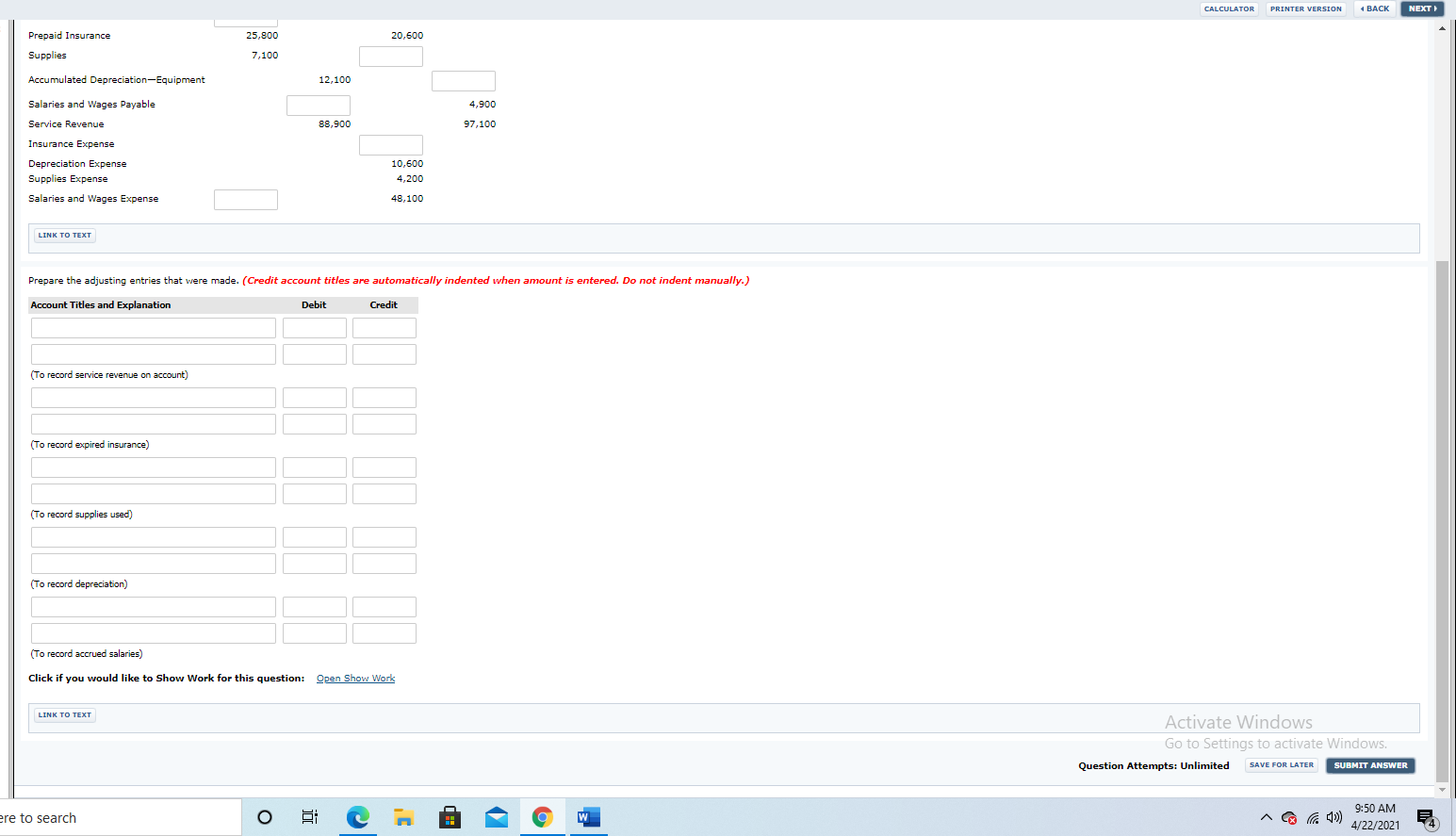

Exercise 4-06 a-b Selected worksheet data for Cullumber Company are presented below. Trial Balance Debit Credit ? 25,800 7,100 12,100 Adjusted Trial Balance Debit Credit 33.600 20,600 ? ? Account Titles Accounts Receivable Prepaid Insurance Supplies Accumulated Depreciation-Equipment Salaries and Wages Payable Service Revenue Insurance Expense Depreciation Expense Supplies Expense Salaries and Wages Expense 4,900 97,100 88,900 ? 10,600 4,200 48,100 ? Fill in the missing amounts. Trial Balance Debit Credit Adjusted Trial Balance Debit Credit Account Titles Accounts Receivable 33,600 Prepaid Insurance 25,800 20,600 Supplies 7,100 Accumulated Depreciation Equipment 12,100 Salaries and Wages Payable 4,900 Service Revenue 88,900 97,100 Insurance Expense Depreciation Expense Supplies Expense Salaries and Wages Expense 10,600 4,200 48,100 LINK TO TEXT Prepare the adjusting entries that were made. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit (To record service revenue on account) Activate Windows Go to Settings to activate Windows, (To record expired insurance) to search O a W Ca 4)) 9:50 AM 4/22/2021 CALCULATOR PRINTER VERSION 4 BACK NEXT NEXT Prepaid Insurance 25,800 20,600 Supplies 7,100 Accumulated Depreciation Equipment 12,100 Salaries and Wages Payable 4,900 Service Revenue 88,900 97,100 Insurance Expense Depreciation Expense Supplies Expense Salaries and Wages Expense 10,600 4,200 48,100 LINK TO TEXT Prepare the adjusting entries that were made. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit (To record service revenue on account) (To record expired insurance) (To record supplies used) (To record depreciation) (To record accrued salaries) Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT Activate Windows Go to Settings to activate Windows. Question Attempts: Unlimited SUBMIT ANSWER SAVE FOR LATER ere to search o OT W 9:50 AM 4/22/2021 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts