Question: Exercise 4-09 (Part Level Submission) Presented below is information related to Blossom Corp. for the year 2020. Prepare a separate retained earnings statement for 2020

Exercise 4-09 (Part Level Submission)

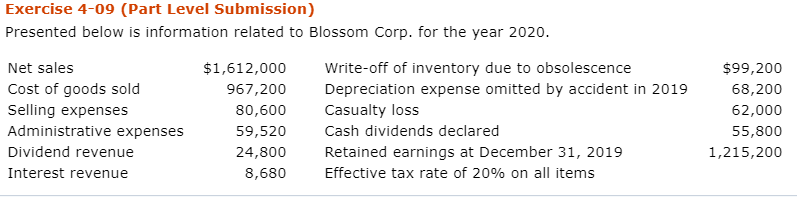

Presented below is information related to Blossom Corp. for the year 2020.

Prepare a separate retained earnings statement for 2020

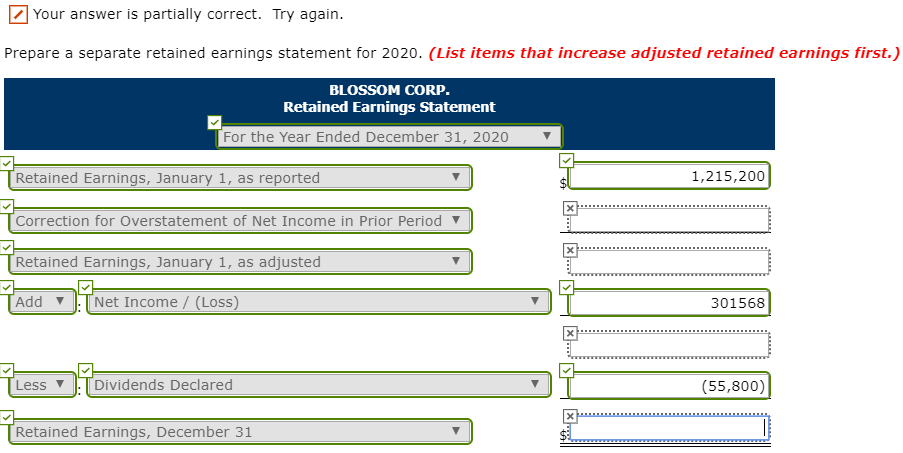

Your answer is partially correct. Try again. Prepare a separate retained earnings statement for 2020. (List items that increase adjusted retained earnings first.) BLOSSOM CORP. Retained Earnings Statement For the Year Ended December 31, 2020 Retained Earnings, January 1, as reported 1,215,200 Correction for Overstatement of Net Income in Prior Period Retained Earnings, January 1, as adjusted Net Income / (Loss) Add 301568 X Dividends Declared Less (55,800) Retained Earnings, December 31 Exercise 4-09 (Part Level Submission) Presented below is information related to Blossom Corp. for the year 2020. Net sales $1,612,000 Write-off of inventory due to obsolescence $99,200 Depreciation expense omitted by accident in 2019 Casualty loss Cost of goods sold 967,200 68,200 Selling expenses 62,000 80,600 Administrative expenses Cash dividends declared 55,800 59,520 Dividend revenue 24,800 Retained earnings at December 31, 2019 1,215,200 Interest revenue Effective tax rate of 20% on all items 8,680

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts