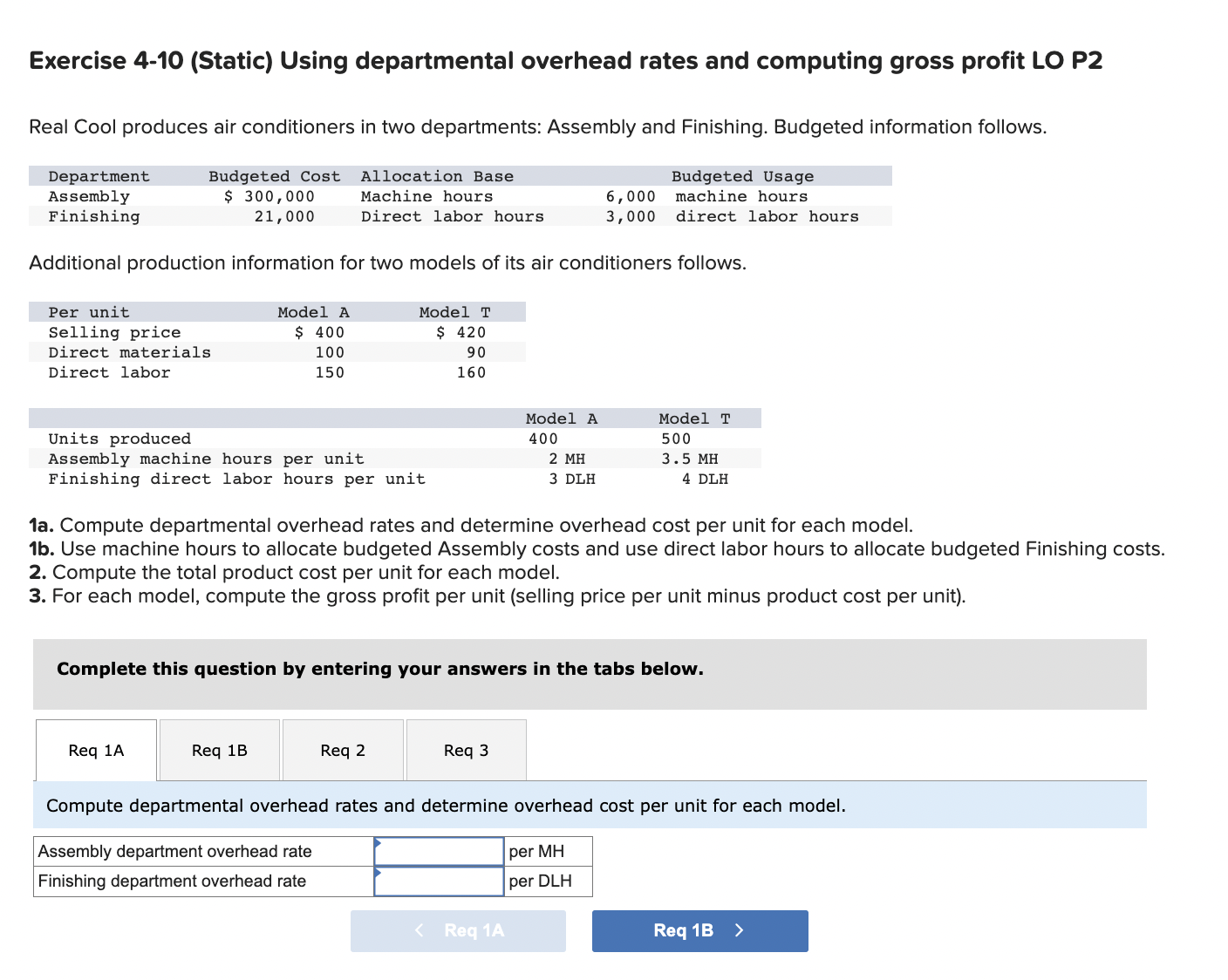

Question: Exercise 4-10 (Static) Using departmental overhead rates and computing gross profit LO P2 Real Cool produces air conditioners in two departments: Assembly and Finishing. Budgeted

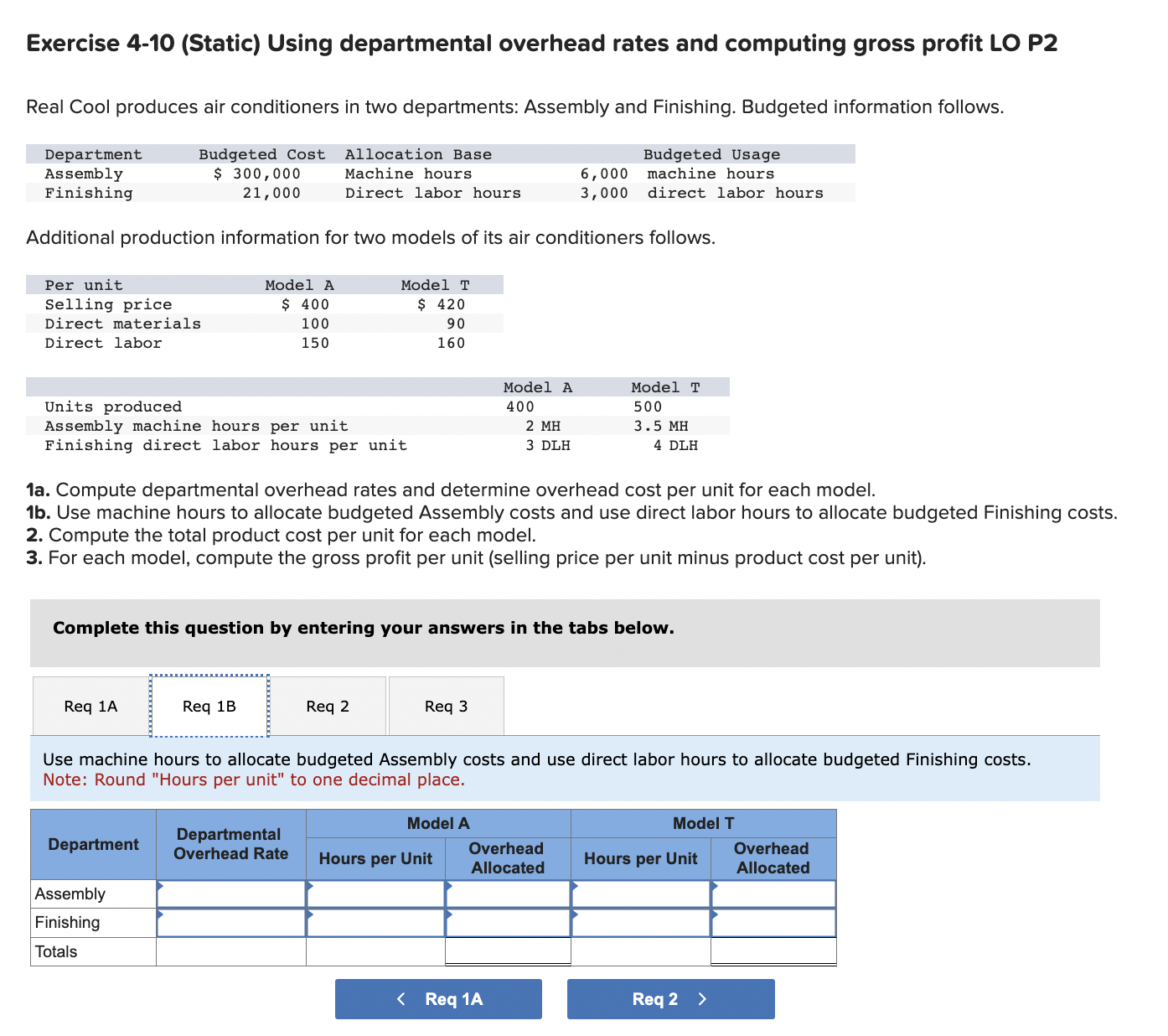

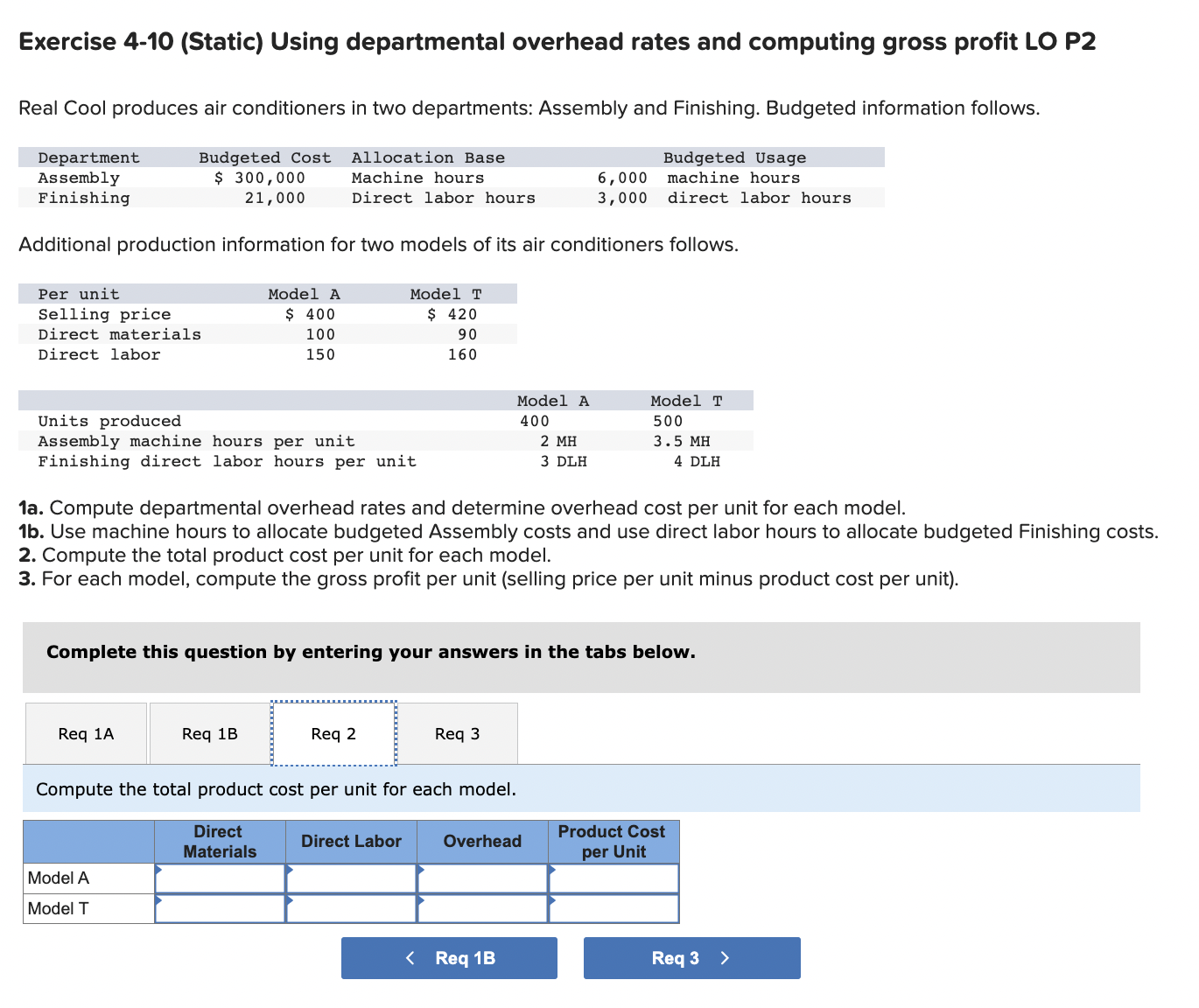

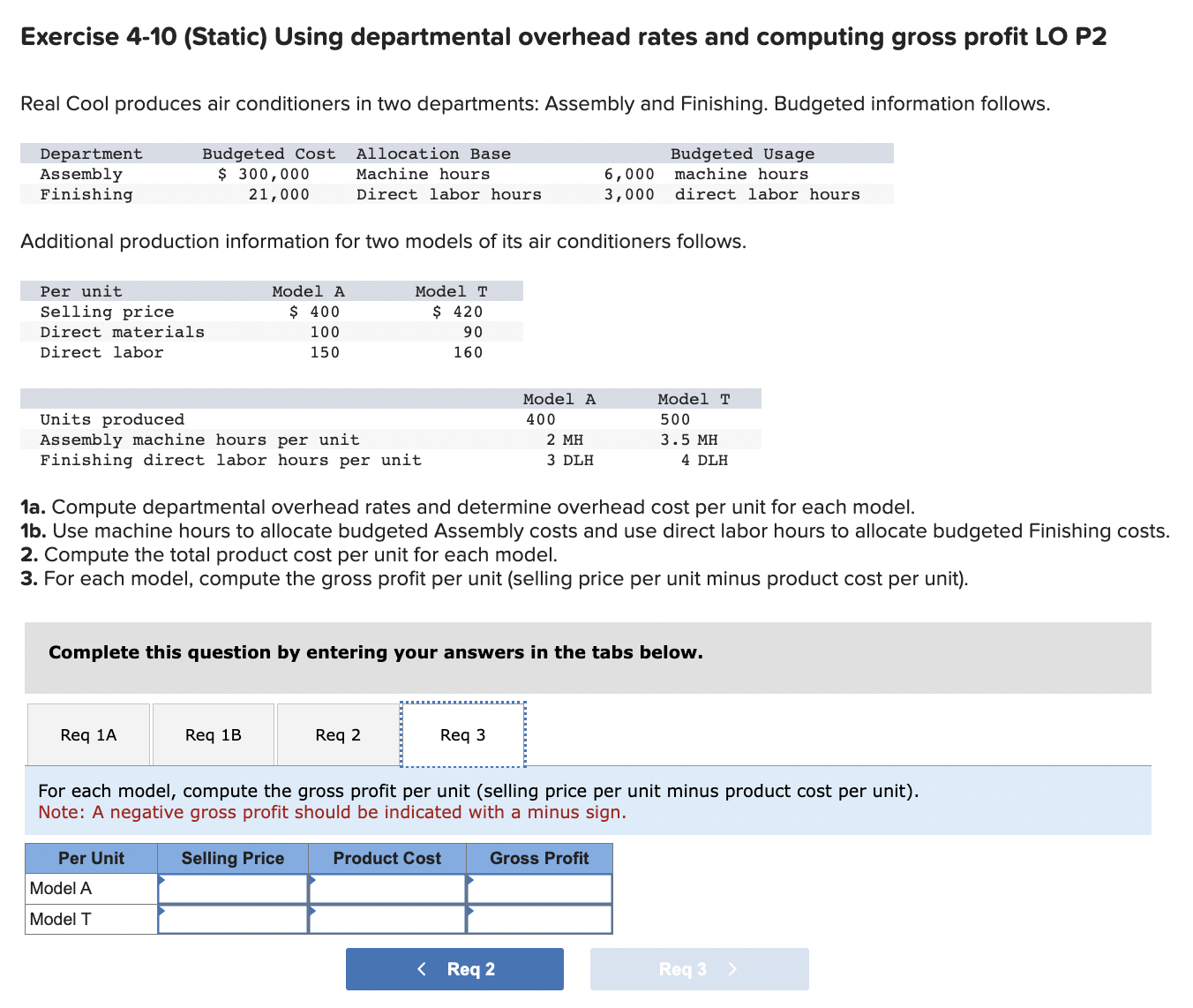

Exercise 4-10 (Static) Using departmental overhead rates and computing gross profit LO P2 Real Cool produces air conditioners in two departments: Assembly and Finishing. Budgeted information follows. Additional production information for two models of its air conditioners follows. 1a. Compute departmental overhead rates and determine overhead cost per unit for each model. 1b. Use machine hours to allocate budgeted Assembly costs and use direct labor hours to allocate budgeted Finishing costs. 2. Compute the total product cost per unit for each model. 3. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). Complete this question by entering your answers in the tabs below. Compute departmental overhead rates and determine overhead cost per unit for each model. Exercise 4-10 (Static) Using departmental overhead rates and computing gross profit LO P2 Real Cool produces air conditioners in two departments: Assembly and Finishing. Budgeted information follows. Additional production information for two models of its air conditioners follows. 1a. Compute departmental overhead rates and determine overhead cost per unit for each model. 1b. Use machine hours to allocate budgeted Assembly costs and use direct labor hours to allocate budgeted Finishing costs. 2. Compute the total product cost per unit for each model. 3. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). Complete this question by entering your answers in the tabs below. Use machine hours to allocate budgeted Assembly costs and use direct labor hours to allocate budgeted Finishing costs. Note: Round "Hours per unit" to one decimal place. Exercise 4-10 (Static) Using departmental overhead rates and computing gross profit LO P2 Real Cool produces air conditioners in two departments: Assembly and Finishing. Budgeted information follows. Additional production information for two models of its air conditioners follows. 1a. Compute departmental overhead rates and determine overhead cost per unit for each model. 1b. Use machine hours to allocate budgeted Assembly costs and use direct labor hours to allocate budgeted Finishing costs. 2. Compute the total product cost per unit for each model. 3. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). Complete this question by entering your answers in the tabs below. Compute the total product cost per unit for each model. Exercise 4-10 (Static) Using departmental overhead rates and computing gross profit LO P2 Real Cool produces air conditioners in two departments: Assembly and Finishing. Budgeted information follows. Additional production information for two models of its air conditioners follows. 1a. Compute departmental overhead rates and determine overhead cost per unit for each model. 1b. Use machine hours to allocate budgeted Assembly costs and use direct labor hours to allocate budgeted Finishing costs. 2. Compute the total product cost per unit for each model. 3. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). Complete this question by entering your answers in the tabs below. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). Note: A negative gross profit should be indicated with a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts