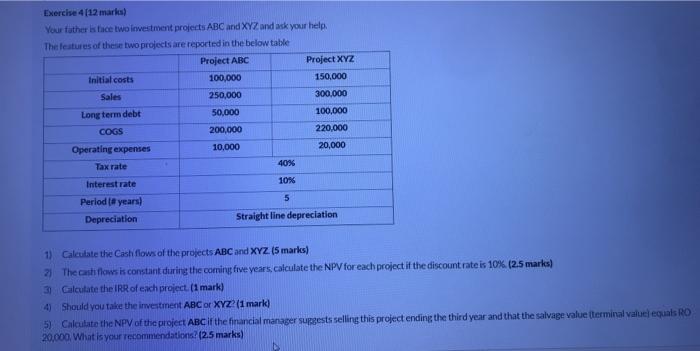

Question: Exercise 4(12 marks) Your father is face two investment projects ABC and XYZ and ask your help The features of these two projects are reported

Exercise 4(12 marks) Your father is face two investment projects ABC and XYZ and ask your help The features of these two projects are reported in the below table Project ABC Project XYZ Initial costs 100,000 150,000 Sales 250,000 300,000 Long term debt 50,000 100,000 COGS 200,000 220,000 Operating expenses 10,000 20,000 Tax rate 40% Interest rate 10% Period (years) 5 Depreciation Straight line depreciation 1) Calculate the cash flows of the projects ABC and XYZ (5 marks) 7 The cash flows is constant during the coming five years, calculate the NPV for each project if the discount rate is 10%. (2.5 marks) 31 Calculate the IRR of each project. (1 mark) 4) Should you take the investment ABC or XYZ (1 mark) 5) Calculate the NPV of the project ABC if the financial manager supgests selling this projectending the third year and that the salvage value (terminal value equals RO 20,000. What is your recommendations (2.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts