Question: Exercise 4-20 (Algorithmic) (LO. 2) On January 1, 2020, Kunto, a cash basis taxpayer, pays $88,758 for a 24-month certificate. The certificate is priced to

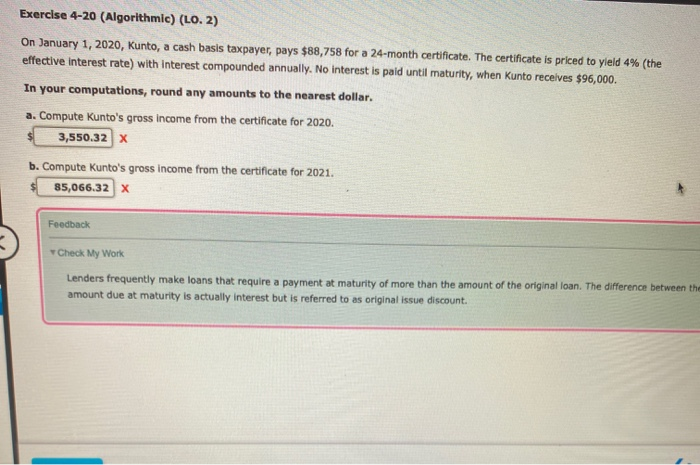

Exercise 4-20 (Algorithmic) (LO. 2) On January 1, 2020, Kunto, a cash basis taxpayer, pays $88,758 for a 24-month certificate. The certificate is priced to yield 4% (the effective interest rate) with interest compounded annually. No interest is paid until maturity, when Kunto receives $96,000. In your computations, round any amounts to the nearest dollar. a. Compute Kunto's gross income from the certificate for 2020. 3,550.32 x b. Compute Kunto's gross income from the certificate for 2021. 85,066.32 x Feedback Check My Work Lenders frequently make loans that require a payment at maturity of more than the amount of the original loan. The difference between the amount due at maturity is actually interest but is referred to as original issue discount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts