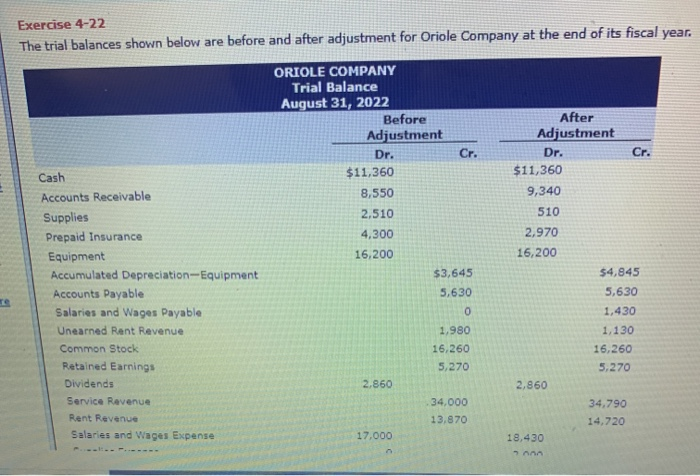

Question: Exercise 4-22 The trial balances shown below are before and after adjustment for Oriole Company at the end of its fiscal year. ORIOLE COMPANY Trial

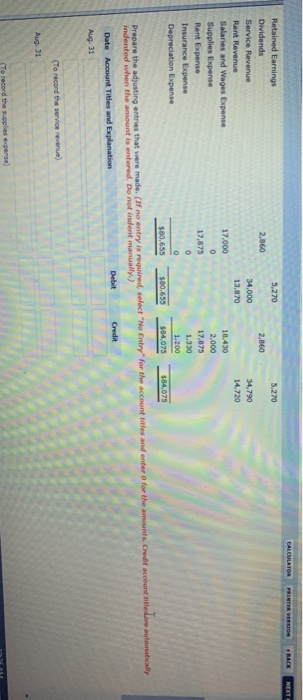

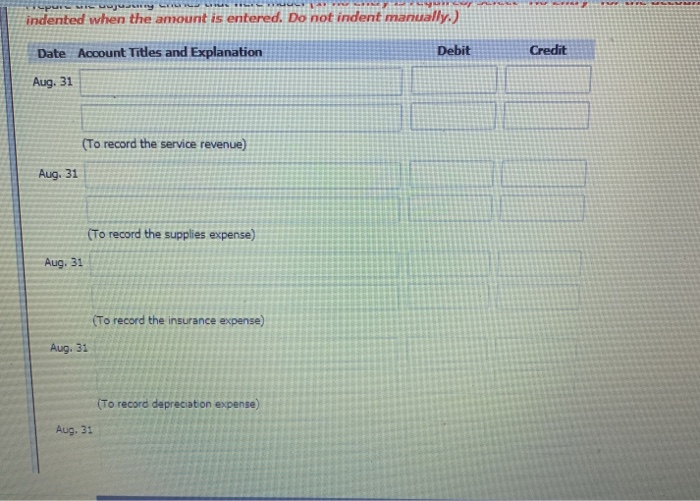

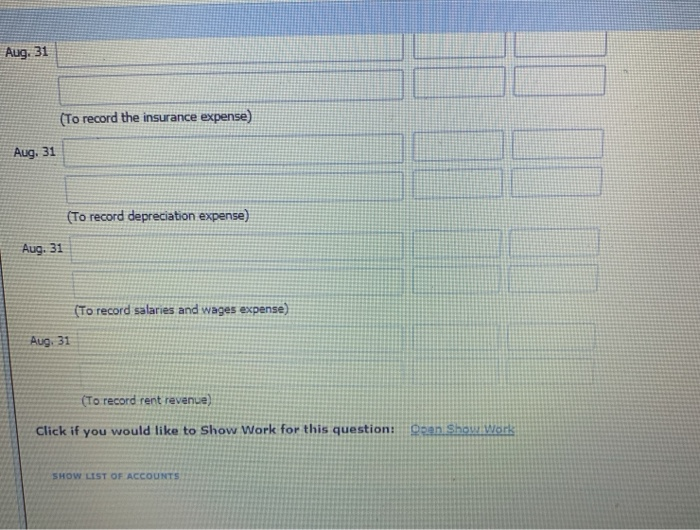

Exercise 4-22 The trial balances shown below are before and after adjustment for Oriole Company at the end of its fiscal year. ORIOLE COMPANY Trial Balance August 31, 2022 Before Adjustment Dr. $11,360 8.550 Cr. Cr. After Adjustment Dr. $11,360 9,340 510 2,970 16,200 2.510 4,300 16,200 $3,645 $4,845 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Unearned Rent Revenue Common Stock Retained Earnings Dividends Service Revenue Rent Revenue Salaries and Wages Expense 5,630 0 1.980 16.260 5,270 5,630 1,430 1,130 16,260_ 5.270 2,860 2,860 34,000 13.870 34,790 14,720 17.000 18,430 NEXT CALCULATOR PRINTER VERSION Retained Earnings 5,270 5.270 Dividends 2,860 2,860 Service Revenue 34,000 34.790 Rent Revenue 13,870 14.720 Salaries and Wages Expense 17.000 18,430 Supplies Expense 0 2.000 Rent Expense 17.075 17.075 Insurance Expense 0 1.330 Depreciation Expense 1,200 $80,655 $80,655 584,075 584,075 Prepare the adjusting entries that were made. (If no entry is required, select "No Entry" for the account binies and enter for the amounts. Credit account witte Le automatically indented when the amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation 0 Aug 31 (To record the service revenue) Aug 31 To record the supplies expense) PU Uuty C -- . indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Aug. 31 (To record the service revenue) Aug. 31 (To record the supplies expense) Aug. 31 (To record the insurance expense) Aug. 31 (To record depreciation expense) Aug. 3: Aug. 31 (To record the insurance expense) Aug. 31 (To record depreciation expense) Aug. 31 (To record salaries and wages expense) Aug 31 (To record rent revenue) Click if you would like to Show Work for this question: Dean Show Work SHOW LIST OF ACCOUNTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts